Unity Bank Shareholders have approved landmark merger with Providus Bank.

NewsOnline Nigeria reports that the shareholders of Unity Bank Plc have given overwhelming approval for the bank’s proposed merger with Providus Bank Limited, setting the stage for the creation of a stronger and more competitive financial institution.

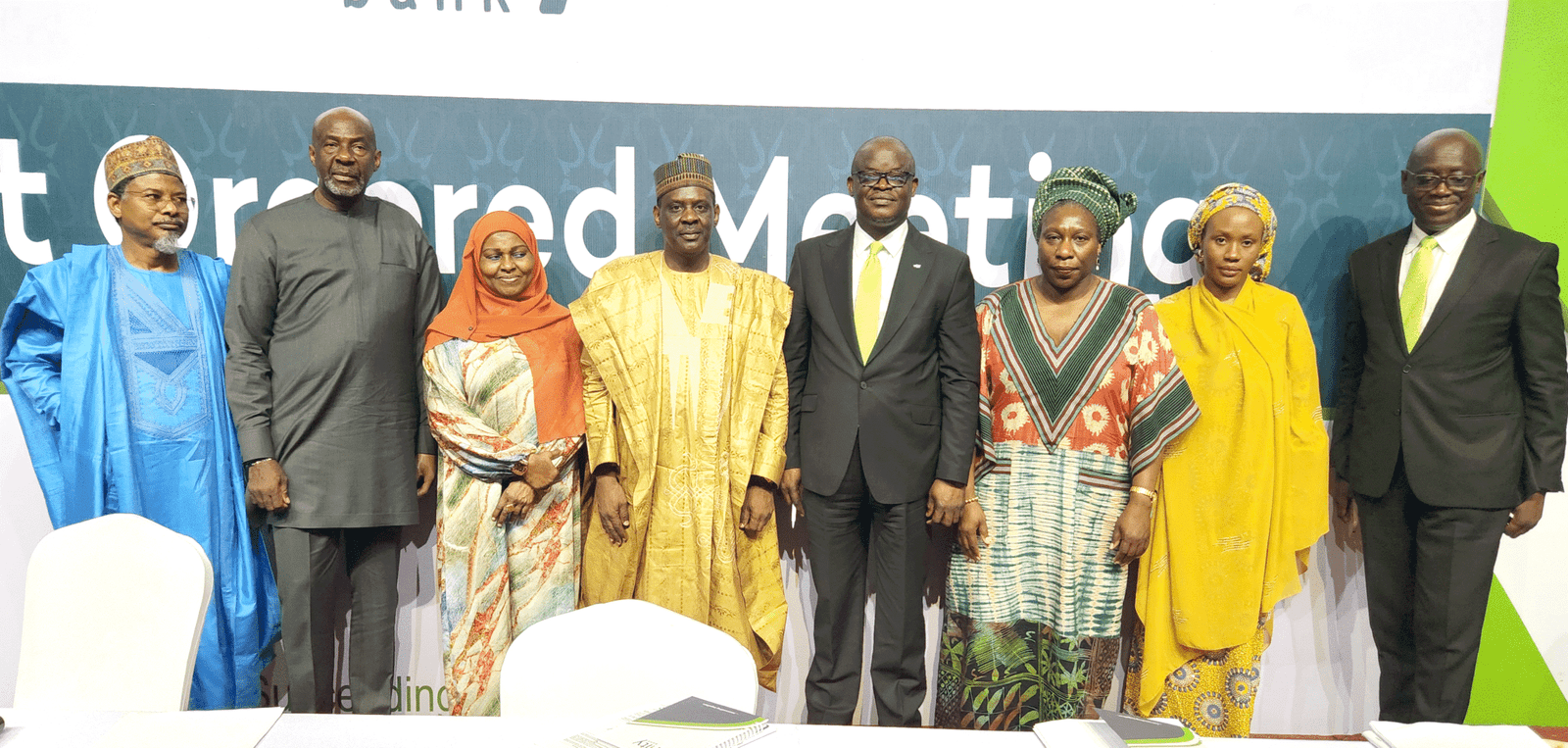

At the Court-Ordered Meeting held at the OOPL Hotel, Abeokuta, Ogun State, 295 shareholders participated in the vote. A total of 293 shareholders, representing 99.32% of the bank’s ₦4.4 billion shareholding, voted in favour of the resolutions, while only two shareholders (0.68%) voted against.

ALSO: Lotus Bank Security Breach Sparks Investor Panic as Hackers Drain Millions

Under the approved Scheme of Merger, Unity Bank shareholders will receive ₦3.18 per share or be allotted 18 ordinary shares of ₦0.50 each in Providus Bank Limited for every 17 ordinary shares of Unity Bank Plc held. Upon completion, Unity Bank’s share capital will be cancelled, and the institution dissolved without winding up, while Providus Bank will retain its certificate of incorporation as the enlarged entity.

The combined institution will operate under a new name, Providus-Unity Bank (PUB), reflecting its expanded national outlook and strategic loyalty in northern Nigeria.

Chairman of Unity Bank Plc, Hafiz Mohammed Bashir, described the shareholders’ decision as a “resounding vote of confidence.” He added:

“By joining forces with Providus Bank, we are building a stronger, more resilient institution with the scale and capacity to deliver long-term value to our shareholders, customers, and the Nigerian economy.”

Bashir further clarified that the Nigerian Exchange (NGX) had lifted the suspension of trading in Unity Bank shares on September 25, 2025. He noted that the remarkable crossing of 4.004 billion units of AMCON shares (representing 34% of Unity Bank’s issued shares) was acquired by an existing shareholder, not Providus Bank.

Shareholders also authorised the bank’s directors and advisers to obtain the necessary court approvals and complete all regulatory requirements to implement the scheme.

Market analysts have hailed the approval as a decisive step toward creating a financial powerhouse with strong market positioning, enhanced customer reach, and the technological edge to compete effectively in Nigeria’s evolving banking landscape.