Wema Bank has released Audited Results for FY 2024, and Profit Before Tax soars 135% to ₦102.5 billion.

NewsOnline Nigeria reports that Wema Bank Nigeria (“Wema” or “the Bank”) has released its audited Consolidated Financial Statements for the period ending December 31st, 2024, to the Nigerian Exchange Group (NGX).

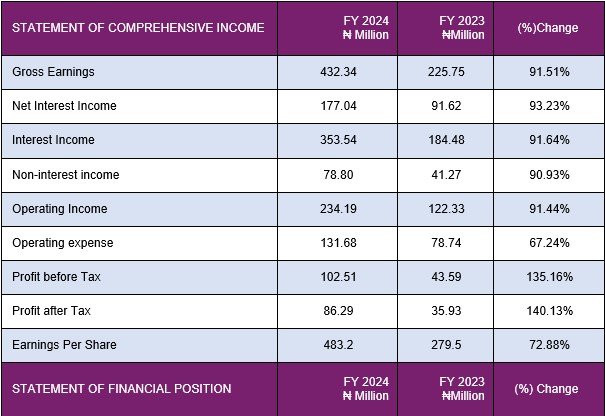

Wema Bank reported a profit before tax of ₦102.51bn, representing an increase of 135% over the ₦43.59bn recorded in the corresponding period in 2023. The Bank also proposed a dividend of N1.00 per share on the back of the impressive result.

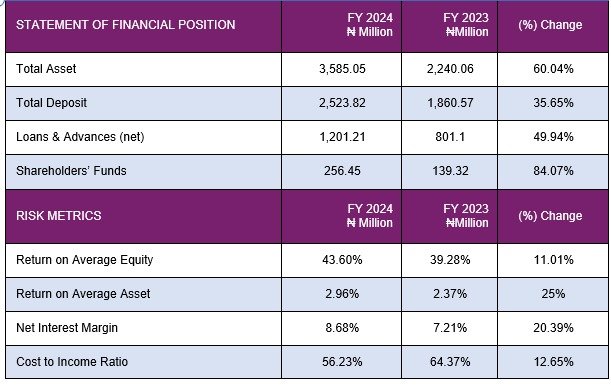

The Bank’s Balance sheet remained well-structured, diversified and resilient, with Total Assets growing by 60% to ₦3,585.05bn in FY 2024 from ₦2,240.06bn in FY 2023. The bank also grew its deposit base year-on-year by 36% to ₦2,523.82bn from ₦1,860.57bn reported in FY 2023. Loans and Advances grew by 50% to ₦1,201.21bn in FY 2024 from ₦801.10bn in FY 2023. NPL stood at 3.86% at the end of FY 2024.

The bank recorded improved year-on-year performance as Gross Earnings grew by 92% to ₦432.34bn (FY 2023: ₦225.75bn). Interest Income was up 92% y/y to ₦353.54bn (FY 2023: ₦184.48bn). Also, Non-Interest Income was up 91% y/y to ₦78.80bn (FY 2023: ₦41.27bn).

Return on Equity (ROAE) of 43.60%, Return on Assets (ROAA) of 2.96%, Capital Adequacy Ratio (CAR) of 19.67% and Cost to Income ratio of 56.23% underscore the commercial bank’s resilience and financial strength.

The Managing Director/CEO of the Bank, Mr. Moruf Oseni stated that the strong 2024 FY performance stems from the commercial bank’s focus on strong strategy execution in the key areas of risk management, customer relationship management and digital banking.

Our people are committed to the institution’s founding ethos of supporting Nigerian businesses and individuals with the most innovative banking products and services.

ALAT, our flagship digital platform, continues to lead in the adoption of digital banking services across the increasingly young Nigerian populace. An example of this innovation is ALAT XPlore, the first licensed banking App for teenagers designed to help teenagers ages 13-17 build their money management skills, achieve their financial goals and become financially responsible.

Despite the constrained operating environment, the bank continues to experience strong growth across all its financial indices, reflecting the quality and resilience of the workforce. The performance is headlined by impressive improvements in Profit before Ta,x which grew strongly by 135%. The growth of Gross Earnings by 92%, Total Assets by 60% and earnings per share at 483.20kobo shows the core improvements to our balance sheet. In addition, our cost-to-income ratio of 56.23% has witnessed significant improvement from the previous period.

Finally, it is important to mention that the Bank’s Capital Raise Program will also commence in April 2025 with a N150bn Rights Issue.