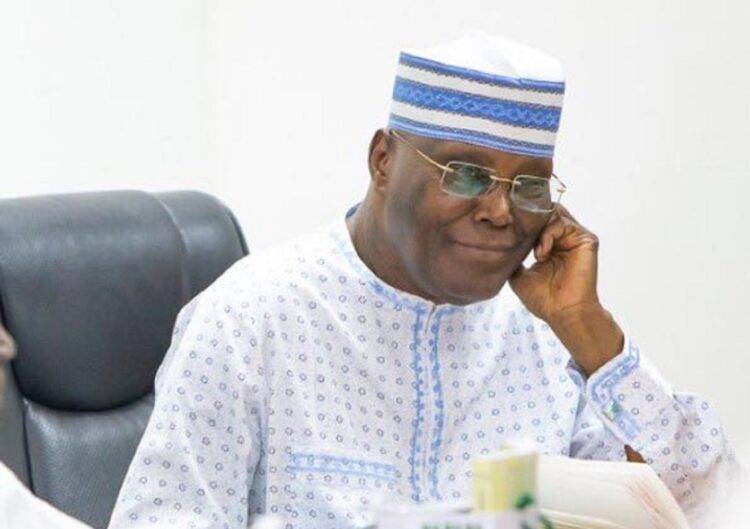

Tinubu Government has lambasted Atiku over claim on NNPC’s $3.3b loan.

NewsOnline Nigeria reports that the Presidency has fired Former Vice President Atiku Abubakar over his request for an explanation from the President Bola Ahmed Tinubu Administration on the emergency $3.3 billion loan sourced by the Nigeria National Petroleum Corporation Limited (NNPCL).

In a statement, Atiku had said the administration owed Nigerians an explanation for the emergency crude-for-cash loan arranged by the African Export-Import (AFREXIM) Bank.

But the Special Assistant to the President on Social Media, Segun Dada, said the former Number Two Citizen got the wrong information.

READ ALSO: FG Fixes Date To Deliberate On Minimum Wage With Labour Unions

“The Project Gazzelle is such a straight-forward deal that I do not expect Alhaji Atiku, who prides his whole political aspirations on being an economic reformer, to fumble the simple numbers behind it,” the presidential assistant said.

Atiku said the AFREXIM facility was meant to prop up the naira and stabilise the Foreign Exchange (FOREX) market.

He said: “The curious thing about this transaction is that up till now, the Federal Government continues to keep mum about it, and the only information available to the public on the mega deal is coming only through unofficial sources from the NNPCL.

“According to information available, a Special Purpose Vehicle (SPV), called Project Gazelle Funding Limited, is driving the deal, and it was incorporated in the Bahamas.

“The SPV is the borrower while the NNPCL is the sponsor, with an agreement to pay with crude oil to the SPV in order to liquidate the loan at an interest rate that is a little over 12 per cent.

“What is even more confounding about this deal is why the Federal Government would register a company in the Bahamas, knowing full well the recent scandal of the Paradise Papers that involved that country.

“Curiously also, Nigeria’s current Barrels Produced Daily (BPD) is 1.38 million, and according to the Project Gazelle deal, Nigeria is to supply 90,000 barrels of its daily production, starting from 2024 till it is up to 164.25 million barrels for the repayment of the loan.

“Now, this is where the details get disturbing because Nigeria’s benchmark for the sale of crude per barrel in 2024 is $77.96. A simple multiplication of that figure by 164.25 will give us a whopping $12 billion.”

Among other questions, Atiku asked:

* Has the Federal Government accessed the loan?

* Is the loan in the government’s borrowing plan as approved by the National Assembly?

* Who are the parties to the loan, and what specific roles are they expected to play?

* What are the conditions to the loan, including tenor, repayment terms, the collateral, and the interest rate?

* And, lastly, why register an SPV in the Bahamas, knowing the recent scandal of the country’s notoriety for warehousing unclean assets?

But Dada said the former Vice President missed the point.

He said: “Talking about the Federal Government owing Nigerians an explanation, Alhaji Atiku is late to the party, as usual, as the Presidency had done the needful by explaining the deal to Nigerians few days ago.

“For record purposes and to save Alhaji Atiku from his self-imposed mystery, here are some explanations to his questions about the conditionalities of the loan in a simpler language.”

The presidential aide listed the facts as follows:

* The facility is a forward sales agreement between NNPC Limited and an SPV (the buyer) where a predetermined number of barrels of oil is sold in advance at an agreed price.

* The sales allow the seller (NNPC Limited in this case) to use the received payment to solve critical and urgent problems with forex scarcity as the problem in Nigeria’s case.

* A lower benchmark is usually adopted as a safe haven for the buyer (the SPV) as oil price tends to remain unstable most times.

* For repayment, an eventual increase in oil prices will result in the SPV returning all excesses to the seller (NNPC Limited) while the risk, which could lead to a rearrangement of the terms, is a significant decrease in the agreed price (this case $65 per barrel)

* Oil has been averaging $70-75 per barrel since the deal was agreed, and if things stay the same way, Nigeria will be getting refunds of excess amounts from the SPV once the payment is concluded.

* There is a very big chance that the repayment will be concluded before the agreed time, if oil prices continue to increase, as NNPCL had penned a 90,000 barrel per day, which will eventually be calculated at the current prices.

* Repayment stops when the agreed amount + interest is fully paid and Nigeria may be liable to refunds, were there to be excesses.

Dada added: “I hope Alhaji Atiku, being an elder statesman, will allow the financial expert in charge of the country to continue devising innovative ways of funding our expenditures while he surfs his archives for more promising economists who will advise him duly before rushing to make public comments going forward.”