Stanbic IBTC Bank lost N576,664,517 to cybercriminals over internal bank security breach.

NewsOnline Nigeriareports that Stanbic IBTC Bank lost N576,664,517 to cybercriminals through a breach in its internal bank security and it has commenced the process of tracking and arresting individuals who may have benefited from the fraud.

This Nigeria news platform gathered that the funds were lodged into various accounts through which the fraudsters initiated transactions with innocent individuals and registered companies.

The cybercrime was reported to the Police Special Fraud Unit (PSFU) at Ikoyi in Lagos State. Consequently, the police investigated the money trail and linked it to over 450 accounts domiciled in 37 financial institutions, including fintech companies and microfinance banks.

READ ALSO: New Series “Decoded” Premieres On REDTV, Spotlighting the Dreams and Struggles of Life in Lagos

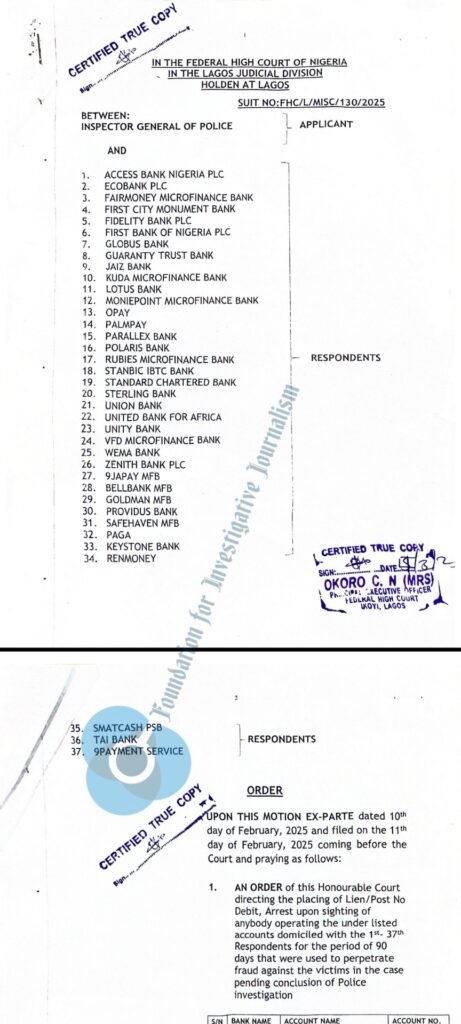

In order to prevent the beneficiaries of the funds from taking the remnants in their accounts, the police applied to the Federal High Court in Lagos State on February 11 through a motion ex-parte marked FHC/L/MISC/130/2025 to freeze their accounts.

The court filing had the Inspector General of Police as the applicant seeking four substantive reliefs while the 37 financial institutions hosting the beneficiaries’ accounts were the respondents.

Filed by Enang, a legal practitioner for the police, the police’s application to freeze those accounts was supported by an affidavit sworn to by Sunday Ubanni, a superintendent of police at the PSFU.

Through a certified true copy of the ex-parte order, Justice Alexander Oluseyi Owoeye empowered the banks to place a post-no-debit on the affected account numbers.

The judge equally empowered the police to arrest any person linked to the suspected accounts for a period of three months.

“That an order of this Honourable Court is hereby granted to the applicant directing the placing of Lien/Post No Debit, arrest upon sighting of anybody operating the under listed accounts domiciled with the Respondents for the period of 90 days that were used to perpetrate fraud against the victims in the case pending conclusion of police investigation,” the first leg of the court order read.

The other legs of the order included a directive to the banks to release the account opening packages of the suspects and their personally identifiable information, statements of account, handing over of the account holders and the reversal of the suspicious funds.

“That an order is hereby granted to the applicant, directing the 1st- 37th respondents’ banks to furnish the Police Investigating Officers with Certified True Copies (CTC) of the following information/documents on the accounts: Certified True Copies of Account Opening Package, Statement of account from 1/1/2023 till date, BVN linked to the accounts and Mandate Cards; telephone numbers receiving alert; post-no-debit on the accounts; certificate of computer printout in compliance with Section 84 of the Evidence Act,” the court ordered.

“That an Order of this Honourable Court is hereby granted to the Applicant directing the 1st. 37th Respondents’ Banks to cause the arrest and handing over the account holders or their representatives to any law enforcement agency within the 1st-37th Respondents’ banking premises.

“That an Order of this Honourable Court is hereby granted to the Applicant directing the Defendants’ banks with account numbers as stated above to reverse/transfer the sum of N576,664,517.50 (Five Hundred and Seventy Six Million, Six Hundred and Sixty Four Thousand, Five Hundred and Seven Naira Fifty Kobo) or whatever is left of the sum fraudulently transferred into the accounts of the Defendants as stated above and which are in the Defendants’ banks and that all sum or whatever is left of the sum in the said accounts be transferred bank to the victims accounts, with account name: Special Reserved Account, account number 9200026167, bank name: Stanbic IBTC, the nominal complainant.”

Alokpesi C.N. signed the certified true copy of the order. The case comes up next on May 28 for report of the police investigation.

When contacted for comments, Ovie Kenneth, the spokesperson for the PSFU, promised to find out and revert to FIJ with feedback.

Given that investigations are still ongoing, FIJ cannot share a complete copy of the ex-parte order publicly available.

A CUSTOMER’S N14.1 MILLION IS FLAGGED AS FRAUDULENT

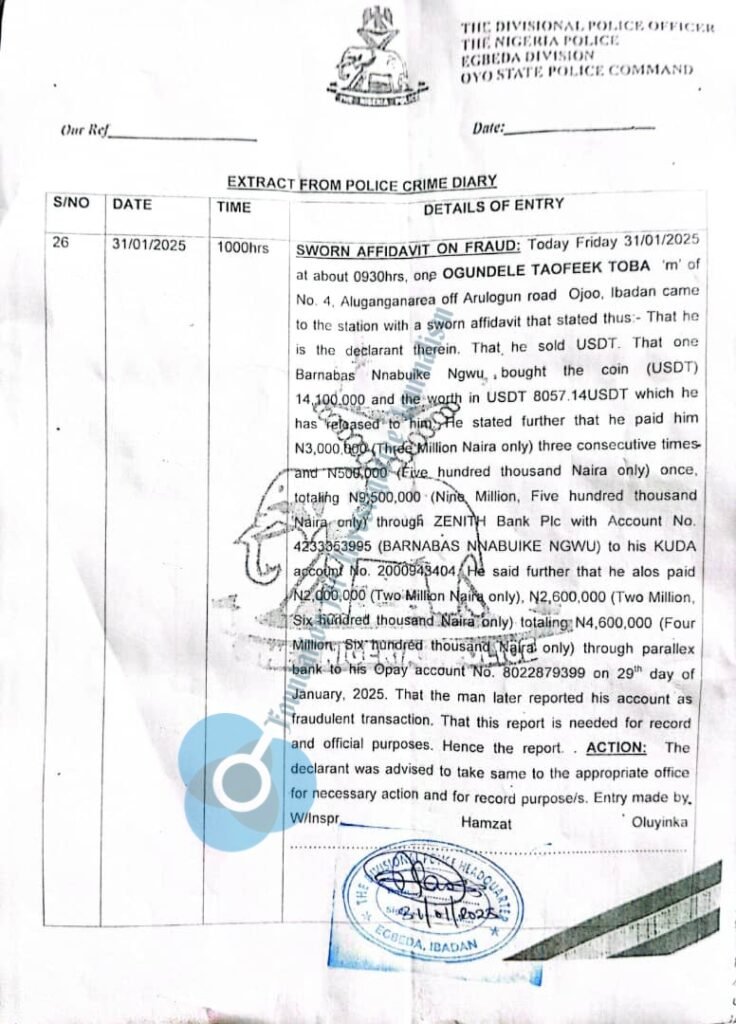

Ogundele Taofeek, a cryptocurrency trader, was one of the persons whose accounts was suspected to have received a part of the stolen funds.

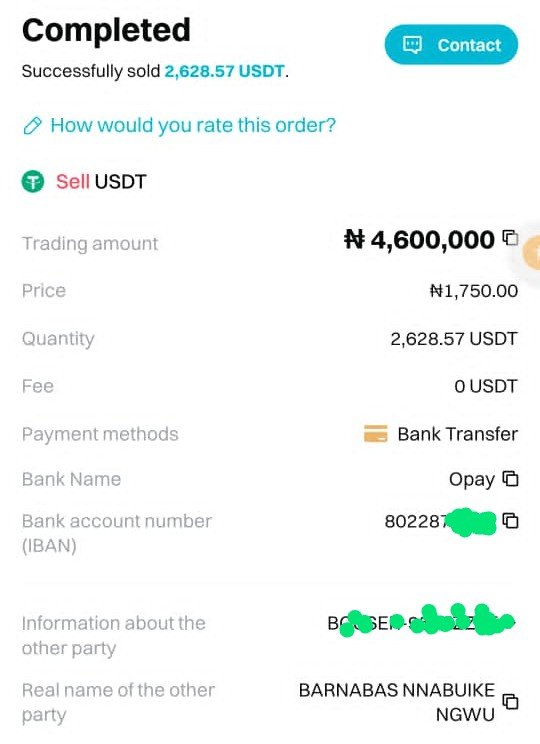

On January 29, Taofeek completed a transaction with Barnabas Nnabuike Nwgu, a Parallex Bank and Zenith Bank customer. He received N14,100,000 in total through his Kuda and OPay wallets in fulfilment of the cryptocurrency deal.

The transaction was without glitches and he had no idea where Ngwu got the money for the transaction from.

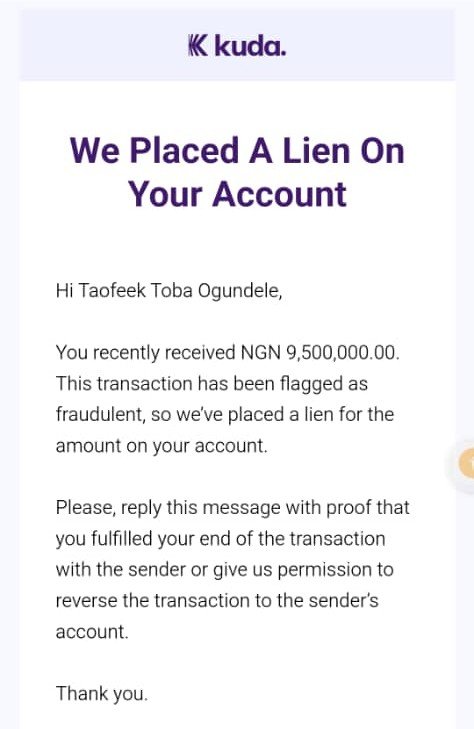

Some hours later, Taofeek’s peace was disturbed when he got separate notifications from Kuda and OPay that the funds had been flagged as fraudulent.

“I received the payment in batches: N3,000,000, N3,000,000, N3,000,000, N500,000 to my Kuda Bank from his Zenith Bank account and N4,600,000 from his Parallex Bank to my OPay account. The payment was successfully credited to my bank account without any issues at the time of receipt,” Taofeek told FIJ on Tuesday.

“Hours later, Kuda notified me that a lien had been placed on the N9.5 million in my account and another message from OPay claiming that I received an erroneous transfer of N4.6 million. I immediately contacted the banks for clarification. After thorough questioning, I was informed that the payments I received were linked to a Stanbic IBTC Bank glitch, a matter of which I had no prior knowledge or involvement.”

The banks asked him to prove his legitimate ownership of the funds by providing a police report and other supporting documents.

“I promptly compiled and submitted transaction receipts, proof of business showing the nature of the transaction, screenshots of my conversation with Ngwu. Kuda further instructed me to obtain a police report to validate my stance and clear my name of any alleged misconduct in which I got for them on January 31,” Taofeek explained.

Upon receiving the information, the banks communicated that they had forwarded it to the reporting bank before the problem could be resolved.

While awaiting feedback from the banks, Kuda emailed Taofeek on March 23 that Stanbic IBTC Bank had served it a court order seeking a reversal of the money in his account.

“To my dismay, the order listed my name alongside Ngwu’s and numerous others as supposed beneficiaries of the Stanbic IBTC glitch, an accusation that is both unfounded and unjust,” Taofeek further explained.

“It is crucial to emphasise that I do not hold an account with Stanbic IBTC Bank and I did not conduct any business with any individual using Stanbic IBTC Bank on the said date.

“My transaction with Ngwu was legitimate, and I received the payment in good faith. Given these facts, I am deeply concerned and frustrated that my funds have been wrongfully frozen due to an issue entirely unrelated to me. I am seeking an immediate intervention to ensure this matter is resolved fairly and to regain access to my hard-earned money without further delay.”

Taofeek also wants a restoration of his financial rights and the removal of his name from any wrongful allegation. He told FIJ that he had hired a lawyer to defend his rights on the matter in court.

Kuda Bank failed to send a response to an emailed inquiry FIJ sent on Friday.

As for OPay, Adeyemi Adekunle, its head of marketing, said on Friday that he would “engage the team involved and provide feedback”.