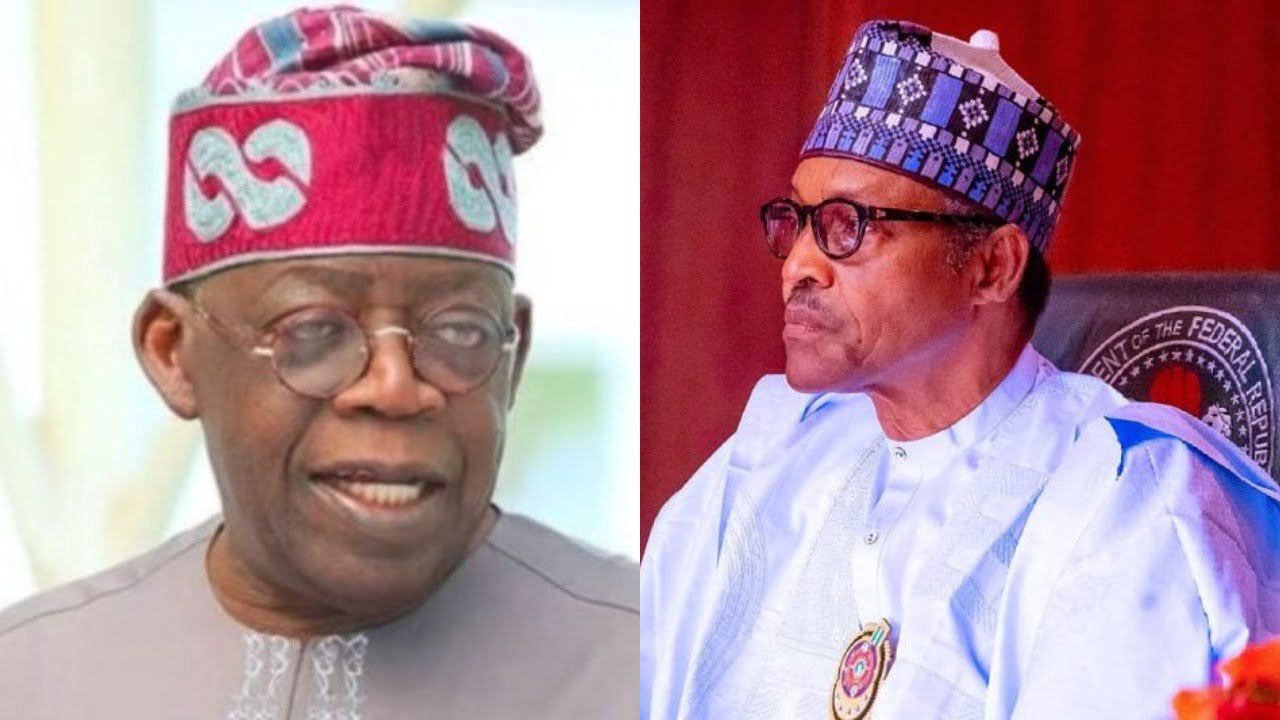

President Tinubu has ended Buhari’s Single Treasury Account and given fresh directives to MDAs.

NewsOnline Nigeria reports that President Bola Tinubu‘s government has instructed all ministries, departments, and agencies fully funded by the federal government to remit 100% of their revenues into the Sub-Recurrent Account, part of the Consolidated Revenue Fund (CRF).

This Nigeria news platform can authoritatively report that the move is aimed at consolidating federal revenue earnings.

ALSO: President Tinubu Approves Extension of 2023 Supplementary Budget Till March

The directives, detailed in a December 28 circular from the Finance Ministry and announced on Tuesday, marks a departure from the single treasury account system used during Muhammadu Buhari’s administration.

This policy is part of the federal cabinet’s broader strategy under President Tinubu to enhance revenue generation, and to promote fiscal discipline, accountability, and transparency in the management of resources and prevention of waste.

The directives read, “All Ministries, Departments and Agencies (MDAS) that are fully funded through the annual federal government budget (receiving personnel, overhead and capital allocation) and on the schedule of Fiscal

“Responsibility Act, 2007 and any addition by the Federal Ministry of Finance should remit one hundred per cent of their Internally Generated Revenue (IGR) to the Sub-Recurrent Account, which is a Sub-component of the Consolidated Revenue Fund (CRF).

“Agencies and departments that are partly funded by the federal government – having budgetary allocations for capital or overhead expenditures – are expected to remit 50 per cent of their gross revenue while statutory revenue like “tender fees, contractor’s registration, sales of government assets, etc should be remitted one 100 per cent to the sub-recurrent account.

“For the avoidance of doubt, the Office of the Accountant-General of the Federation shall open new TSA Sub-Accounts for all Federal Government Agencies/Parastatals listed on the schedule of Fiscal Responsibility Act, 2007 and any additions by the Federal Ministry of Finance, except where expressly exempted.

“The new account opened for Agencies/Parastatal shall be credited with inflows in the old revenue-collecting accounts based on the new policy implementation of 50 per cent auto deduction in line with Finance Act, 2020 and Finance Circular, 2021, 50per cent cost to revenue ratio.

“The Office of the Accountant General of the Federation (0AGF), subject to the categorisation of agencies, shall map and automatically effect direct deduction of 50 per cent on gross revenue of Self/partially funded

“Agency/Parastatals and 100 per cent for fully funded agencies/ parastatals as interim remittance of the amount due to the Consolidated Revenue Fund.”