Flutterwave, Interswitch, Paga, and PayPal are all on the list of 62 licensed IMTOs.

NewsOnline Nigeria understands that the new guidelines issued by the Central Bank of Nigeria (CBN) on International Money Transfer Operators’ (IMTO) operations have created uncertainty over the status of Flutterwave, Interswitch, and a few other fintechs licensed to provide international money transfer services.

This Nigeria news platform recalls that CBN in the new guidelines said banks and fintech are banned from international money transfer services.

ALSO: Aiyedatiwa Nominates Sowore, Ajulo, 4 Others As Commissioners (FULL LIST)

However, while no bank is currently licensed as IMTO, the apex bank is silent on the fate of fintechs already licensed to provide the services.

Aside from Flutterwave and Interswitch, other Nigerian fintechs licensed as IMTO include Paga, Xpress Payment Solutions, and Paycom.

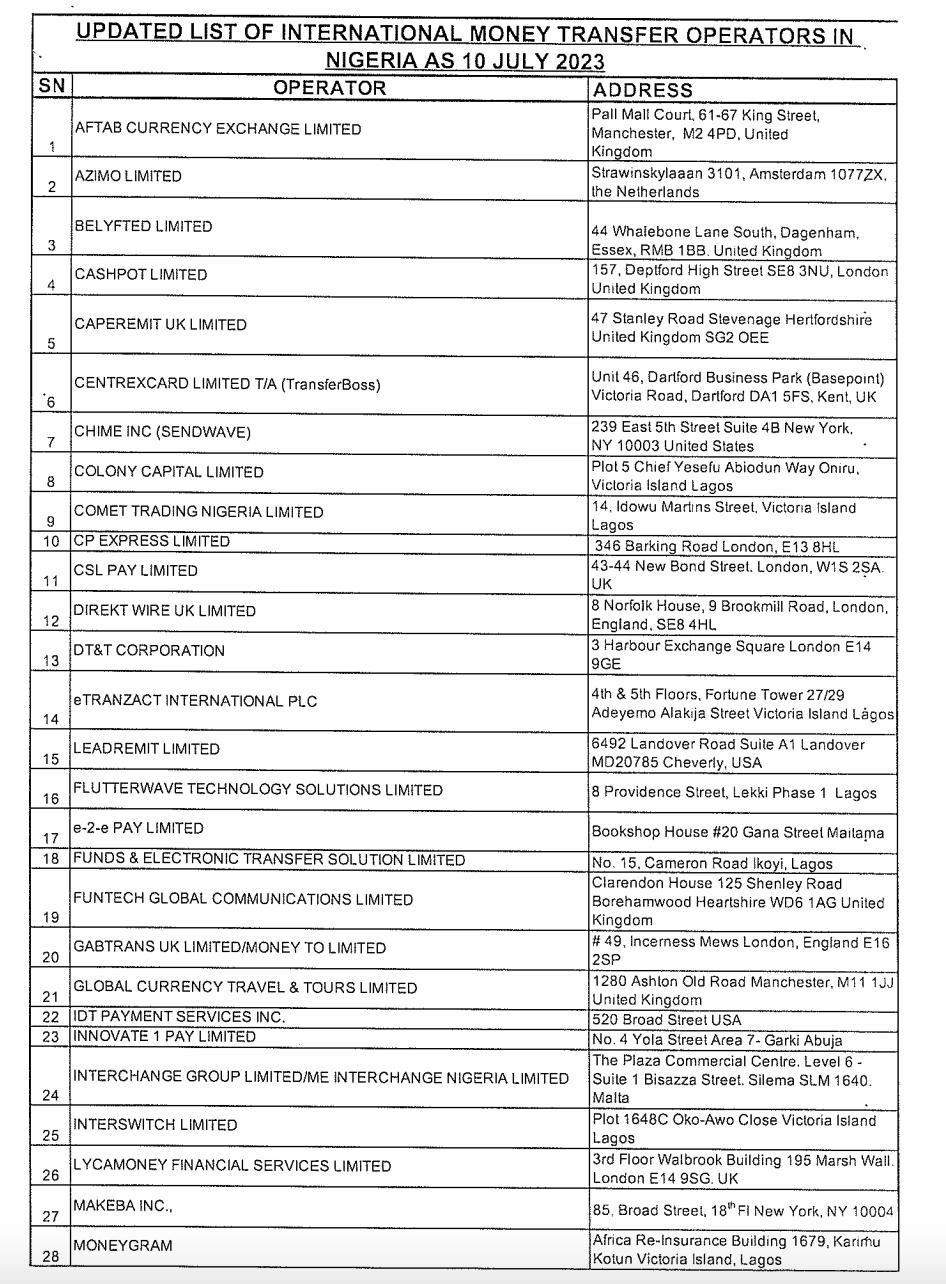

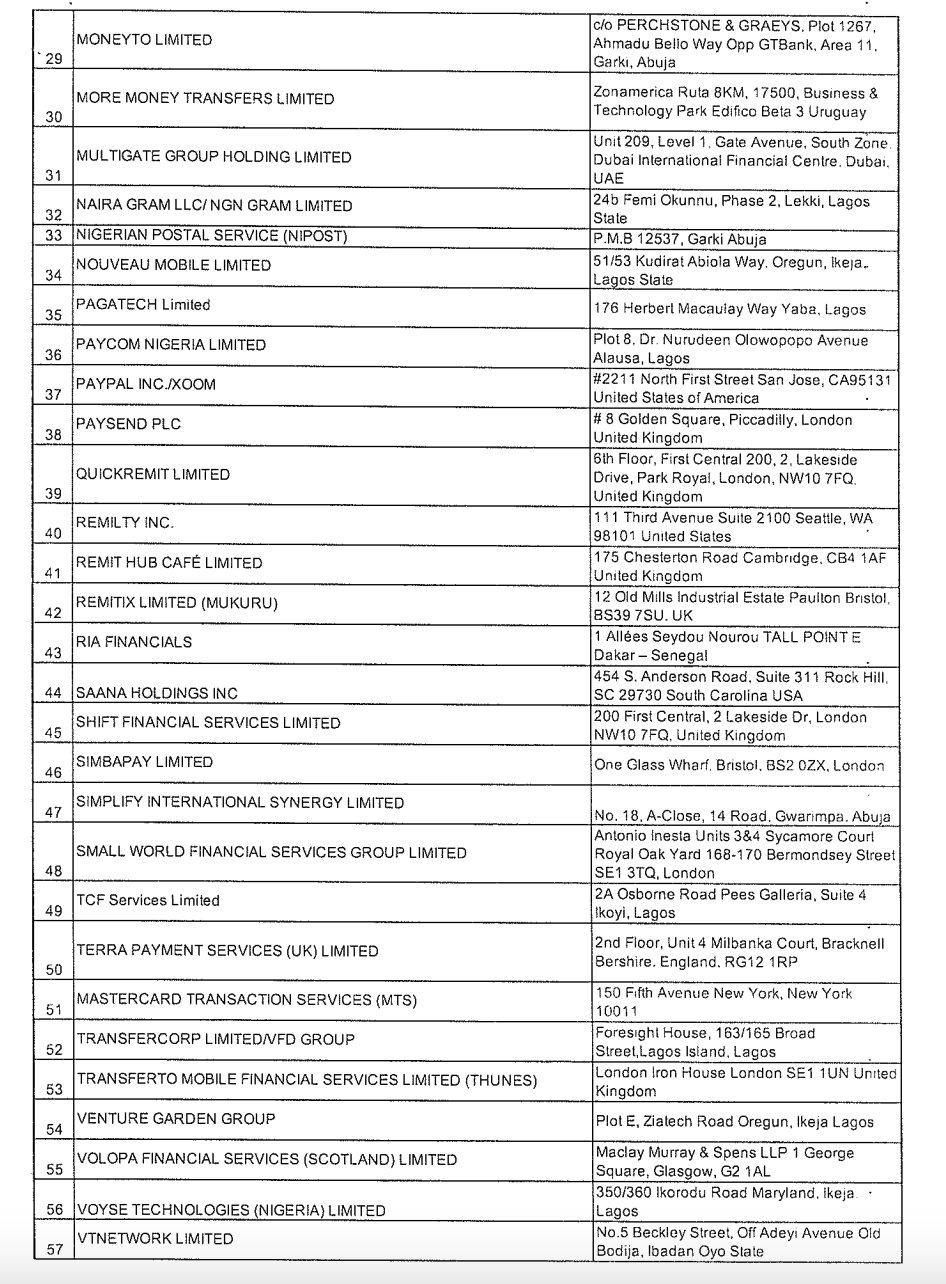

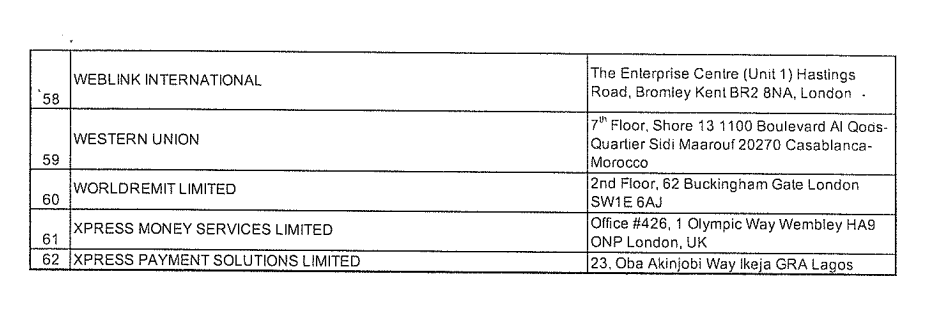

The CBN’s database shows that there are 62 companies licensed as IMTOs in the country, including foreign fintechs.

In the revised guidelines for the operations of IMTOs, which were officially released on January 31, 2024, the CBN said:

- “All banks are prohibited from operating International Money Transfer services but can act as agents.

- “Also, Financial Technology Companies are not allowed to obtain approval for IMTO.”

While this suggests that fintechs can no longer apply for an IMTO licence, the apex bank did not state if the fintechs already issued IMTO can continue to operate with the same licence.

Other changes to the IMTO licence

The apex bank also increased the application fee for an IMTO licence from N500,000 in 2014 to N10 million in the revised guidelines. This is an increase of about 1,900% in about 10 years.

The document noted that any IMTO intending to operate in Nigeria shall submit its application to the Director, Trade and Exchange Department with the following documents, among others:

- “A non-refundable application fee of N10,000,000.00 (Ten Million Naira only) or such other amount that the Bank may specify from time to time; payable to the CBN through electronic transfer or bank draft. Approval to operate in other jurisdictions or agency agreement (for all IMTOs),” it said.

The CBN also established a minimum operating capital requirement for International Money Transfer Operators (IMTOs) at $1 million for foreign entities and an equivalent amount for local IMTOs.

Previously, it was N2 billion for Nigerian companies and N50 million or its equivalent for foreign companies.

The licensed IMTOs

IMTOs, or International Money Transfer Operators, in Nigeria, are companies or organizations authorized by the Central Bank of Nigeria (CBN) to facilitate the transfer of funds from individuals or entities residing abroad to recipients in Nigeria.

As of July 2023, the CBN had licensed 62 companies as IMTOs. See the full list of the licensed companies below: