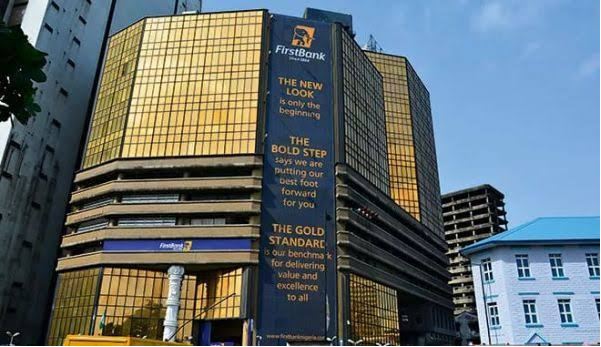

FirstBank has clarified misleading reports and reassured customers of gold standard banking services.

Our attention has been drawn to recent media reports regarding a commercial transaction between First Bank of Nigeria Limited (FirstBank) and General Hydrocarbons Limited (GHL) that is currently a subject of litigation.

As a responsible and law-abiding corporate citizen of Nigeria with the utmost respect for the courts, FirstBank will not be able to offer comments on issues which are pending determination by the courts, as such issues are sub-judice.

However, we are constrained to issue the following clarifications to correct the sponsored but false narratives on the matter presented in some of the media publications.

ALSO: Expanding Footprint – FirstBank Nigeria Sets Sights On Ethiopia, Angola, Cameroon

There is a subsisting commercial transaction between FirstBank as lender, and GHL as borrower, where FirstBank extended several credit facilities to GHL for the development of some Oil Mining Lease assets.

These facilities are backed by very robust loan agreements executed by the parties in which the obligations of the parties are clearly defined and the security arrangement clearly spelt out.

While FirstBank has diligently performed its obligations under the loan agreements, at the root of the present dispute is FirstBank’s demand for good governance and transparency in the transaction, which GHL rejected.

Upon FirstBank’s realization of breaches on the part of GHL including diversion of proceeds, FirstBank requested that an independent operator mutually acceptable to both parties be appointed in line with the terms of the agreement, to operate the financed asset in a transparent manner that will bring greater visibility to the project, protect the interest of, and bring value to all stakeholders. Not only did GHL roundly reject this reasonable and fair request, rather GHL insisted that FirstBank avails it with more funding. GHL refused to execute the terms of offer stipulated by the Bank for the availment of additional funding but rather proceeded to commence needless Arbitral proceedings.

GHL issued a notice to initiate arbitration and has no substantive claim pending at the Federal High Court. GHL approached the Federal High Court solely to seek preservative orders pending arbitration. Some of the preservative orders sought by GHL were granted while others were denied.

FirstBank is the only party that filed a substantive claim against GHL at the Federal High Court and the subject matter of FirstBank ‘s claim is not identical with the dispute GHL submitted to arbitration because FirstBank’s claim is in respect of subsequent credit facilities granted to GHL and the offer letters and finance documents pertaining to the subsequent transactions clearly state that the disputes arising from the subsequent facilities are to be resolved by a court of competent jurisdiction in Nigeria and not by arbitration.

Consequently, it is incorrect to assert that FirstBank abused the process of the court.

GHL off-took crude from the Floating Production Storage and Offloading (FPSO) vessel and diverted the proceeds. The Bank had no choice as a secured lender, under these circumstances of continued breaches, non-payment of due obligations and attempts to shield the Bank away from agreed security and repayment sources, than to approach the court for legal remedies, to preserve assets, recover the diverted proceeds, prevent reoccurrences and safeguard FirstBank’s interest. It is clear to us that the courts do not support or protect illegalities and breaches of contracts.

FirstBank has a long and very rich history of supporting and providing for the financial needs of its customers over its more than 130 years of unbroken existence. FirstBank remains committed to ensuring that it continues to support legitimate business aspirations of its teeming customers. At the same time, FirstBank is committed to the building of a strong credit culture where borrowers pay their debts when they borrow and will always take appropriate steps, within the ambit of the law, to resist attempts by borrowers to repudiate their repayment obligations.

We wish to assure FirstBank’s numerous customers, stakeholders and the general public that FirstBank remains solid, calm, steadfast and unflinching in its resolve to continue to provide first-class services to its teeming customers within and outside the country.

FirstBank also wishes to respectfully thank our shareholders for the indicatively oversubscribed Rights Issue of its parent Company, First Holdco Plc (“FirstHoldco”), in the first round of its capital raise and looks forward to an equally successful final leg of the recapitalization exercise when it is announced by FirstHoldco.