E-Naira Registration 2021 – ENaira app Download – How to Register for E-Naira wallet | E-Naira wallet Login has emerged.

Newsonline reports that the Central Bank of Nigeria (CBN) has launched the official platform for a digital currency called the ‘e-Naira’ earlier today.

BREAKING: eNaira Offcial Platform Goes Live

Remember, that E-Naira is an electronic currency and you will require a wallet to operate it. In this article, we will provide you with a step-by-step guide on how to register for E-Naira wallet. Here, you will alo find the guide on how to do E-Naira wallet Login with ease.

Digital currency is becoming a reality in Nigeria. After two years of contemplation, the CBN has finally announced its intention to achieve 80% financial inclusion by the end of 2021 with the launch of digital naira. As we speak, the implementation of E–Naira is on track as everything is set for the launch date being 1st October 2021.

E-Naira Meaning – What is E-naira?

E-naira is an electronic form of Naira which is a legal tender equal to the value of the Naira. Unlike other Cryptocurrencies that does not have a central regulation, The e-Naira would be regulated by the Central Bank of Nigeria.

The e-Naira would be a Central Bank Digital Currency (CBDC) which means that while it is regulated by the CBN, it is a token that would only exist in digital and electronic form. e-naira

CBDC would be legal tender with one e-naira equivalent to one naira which shows fundamental differences between CBDC and cryptocurrencies.

The E-naira project is facilitated by the CBN in partnership with technical fintech partner, Bitts Inc. CBDC will provide a platform for the government to leverage blockchain technology to maintain a centralised and institutional role over the currency.

About Bitts Inc

Bitts Inc. has been a forerunner in the creation of payment systems that improve social inclusion, financial inclusion and overall sustainable economic growth; the excellence in their operation methods has earned them acknowledgment from the Bretton Woods Institutions – .IMF/World Bank. This is one of the reasons the CBN enlisted them for this crucial exercise.

Also, the company was the first fintech to digitize a national currency on a blockchain by creating a synthetic CBDC with the support of the Governor, Central Bank of Barbados and the country’s Minister of Finance.

ENaira app Download

Remember, this is a digital currency and not a physical coin or paper note. As a result of this, you will need a wallet to store the E-naira token. Just like the physical Naira, the CBN will design the e-Naira usage to still pass through regulated financial institutions, in the form of digital cash to individuals and businesses.

Therefore, the app will be provided by individual banks and other financial institutions. The E-naira app will be made available on Android Google Play Store and Apple iOS store.

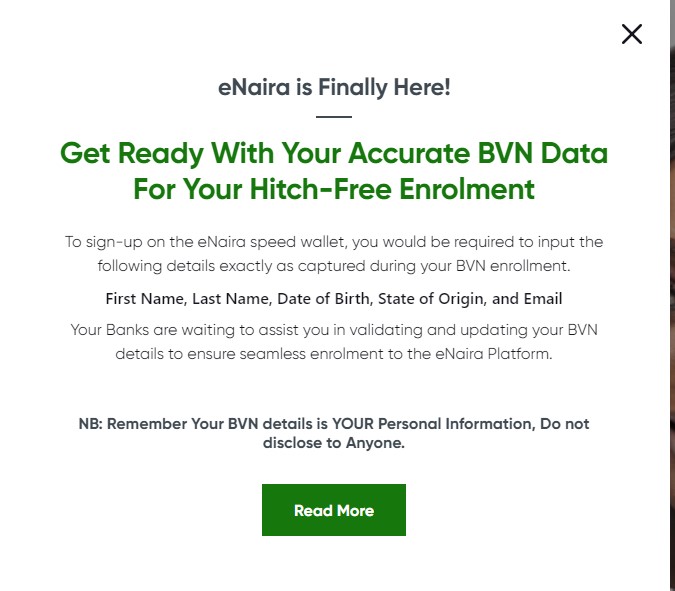

How to Register for E-Naira wallet

E-Naira registration will be free and has gone live from the launch date. As I said earlier, financial institutions in Nigeria will still be relevant for the usage of E-Naira. Hence, you will have to visit your bank and ask the customer care officer to add the E-naira feature on your banking profile. You may be given a form to fill to get your E-naira account created and activated.

How to Get e-Naira?

The CBN has planned a rollout in a tiered manner; first, it will issue the e-Naira, to financial institutions like banks. Your bank will then retail the e-Naira to you. If your transaction value is less than N50,000 a day, you don’t need a bank account to get the eNaira; you can use a NIN verified phone number to buy eNaira. If you want to withdraw more than N50,000 but up to the daily limit of N1 million, then you will need a BVN in addition to a NIN verified phone number. The CBN has very strict ‘Know Your Customers” protocols for this process, the aim being to assure all retailers of the safety and utility of the eNaira.

E-Naira wallet Login

Once you have your E-naira account, you can access your e-Naira wallet by logging in with your credentials to perform transactions electronically

Benefits of E-Naira

With the e-Naira, Nigerians can engage in easier cross-border trade, as well as enjoy a cheaper and faster inflow of remittances. Also, a digital currency would provide more financial opportunities for Nigerians as they would be able to create new business opportunities and financial products and services.

According to the CBN, another perk of the e-Naira is a reduction in the cost of operations and cash management. It would also leave a clearer footprint of digital transactions, making it easier for financial institutions to track transactions.

The eNaira has a low-cost advantage when compared to FIAT. The daily transfers between accounts are at no cost to the holder of the account. Lower transaction cost is a massive incentive as traders will pay no fees for withdrawals and deposits to and from their bank account. No transaction fees reduce the cost of commerce while improving safety.

E-naira Acceptability

It’s expected that all businesses and merchants in Nigeria should accept E-naira as a legal tender.

The Central Bank of Nigeria says the e-naira which is set to be launched on October 1, 2021, is a legal tender equal to the value of the naira and thus must be accepted as a form of payment by all merchants and business outlets.

The CBN Director, Payment System Management, Mr. Musa Jimoh, said this during an interview on the ‘Business Morning’ programme on Channels Television on Monday.

Jimoh said, “Today, anywhere you present naira to pay, compulsorily it must be accepted because that is our fiat currency. So, the same way naira is accepted that you can’t reject it, is the same way e-naira must be accepted. Anywhere in this country where e-naira is presented, it must be accepted. So, merchants must accept e-naira as a means of payment.”

He advised Nigerians to open e-naira wallets which could be downloaded on their phones from October 1, adding that CBN bears all liabilities.

“The liability of the e-naira money is directly on CBN which is similar to the cash you hold. The liability of the cash you hold today rests with the CBN. So, it gives Nigerians the opportunity to bank with CBN,” Jimoh said.

On whether Nigeria was ripe for the e-naira due to the technological challenges in the country, Jimoh said he didn’t expect it to be a major problem.

He added, “E-naira is a journey. We don’t expect that on October 1, all business merchants in Nigeria will accept it. We don’t even expect that come October 1, all Nigerians will have e-naira. It is a journey. It will continue to grow.

How to Accept E-naira Payments

This will be simple. Just like you usually receive electronic money transfers, you will be able to accept payments into your E-Naira wallet from another E-naira wallet seamlessly. We will provide details on this when the electronic currency is fully launched.

We advise you to bookmark this page, visit it regularly for updates and subscribe to get up to date information on eNaira. If you have any questions, kindly share them with us in the comments below.