CBN has warned Nigerian Banks to be vigilant of transactions related to the Benin Republic.

Newsonline reports that the Central Bank of Nigeria has warned Nigerian banks to be vigilant regarding transactions related to the Benin Republic due to intelligence that suggests the country is increasingly becoming a drug trafficking transit and consumption hub in West Africa.

ALSO: Yul Edochie Says He’ll Never Say Anything To Make His 1st Wife Look Bad In Public

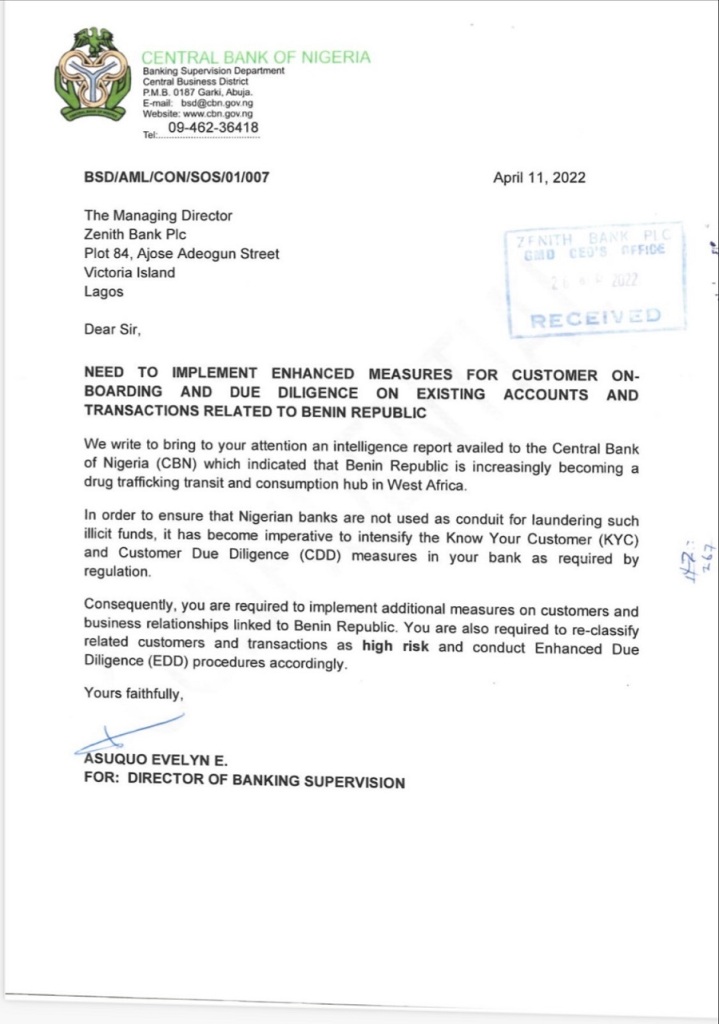

This was disclosed in a circular sent to Nigerian banks titled “NEED TO IMPLEMENT ENHANCED MEASURES FOR CUSTOMER ON-BOARDING AND DUE DILIGENCE ON EXISTING ACCOUNTS AND TRANSACTIONS RELATED TO BENIN REPUBLIC”, signed by Asuquo Evelyn E. for the Director Of Banking Supervision.

The apex bank called for additional measures such as re-classify related customers and conducting Enhanced Due Diligence. CBN also asked Nigerian banks to strengthen its Know Your Customer (KYC) and Customer Due Diligence (CDD) policies, as mandated by regulation.

What the CBN is saying

The CBN said, “We write to bring to your attention an intelligence report availed to the Central Bank of Nigeria (CBN) which indicated that the Benin Republic is increasingly becoming a drug trafficking transit and consumption hub in West Africa.”

The CBN suggested a shield for Nigeria banks to avoid involvement in illicit transactions saying, “In order to ensure that Nigerian banks are not used as conduit for laundering such illicit funds, it has become imperative to intensify the Know Your Customer (KYC) and Customer Due Diligence (CDD) measures in your bank as required by regulation.”

The Bank added “Consequently, you are required to implement additional measures on customers and business relationships linked to Benin Republic. You are also required to re-classify related customers and transactions as high risk and conduct Enhanced Due Diligence (ED) procedures accordingly.”

What has changed?

As a result of the directive, Nigerian banks have implemented the following measures to be applied during account opening involving Beninese nationals, as well as fund transfers to and from the Benin Republic:

- Enhanced Due Diligence would be applied to account opening for Beninese prospects and business ties with Beninese signatories, directors, and shareholders. Enhanced Due Diligence would also be applied to funds transfers to and from the jurisdiction, and the purpose of the transfer must be determined.

- Nigeria banks would take proactive steps to determine the account’s purpose and the customer’s source of income.

- All faulting customers must be classified as “High Risk” for money laundering and marked accordingly in the system.

- To authenticate the transaction in (4), relevant papers such as invoices and other contractual agreements must be gathered and provided to the Compliance Department for evaluation and approval before processing.

What you should know

- The U.S Department of States stated that “due to its strategic location, with a large port and substantial transportation links to Nigeria, Benin is a major transit point for criminal organizations illicitly trafficking narcotics, wildlife, and other contraband.”

- The US DOS added that “Benin’s cash-based economy makes it difficult to track the sources of financial resources and facilitates corruption, money laundering, and other illicit economic activities. Weaknesses in the justice sector and rule of law remain, particularly the backlog of criminal cases and a lack of effective cooperation between national and regional actors to address transnational organized crime and corruption.”

- In the worldwide drug trafficking network, Benin is increasingly becoming a hotspot. Benin’s contribution to the illicit trade has grown to 1.3 tons by June 2021. Latin America and the Middle East are the origins of illegal drugs.

- The Special Prosecutor of the Court for the Repression of Economic Offenses and Terrorism (CRIET) in Benin reported on November 4, 2021, that 750 kg of cocaine had been discovered in a warehouse in Cotonou.

- Since 2019, national law enforcement agencies have made many such big seizures of cocaine and other substances. These include 78 tons of various drugs, with three tons of cocaine shipped from Montevideo in Uruguay to Europe via Benin.