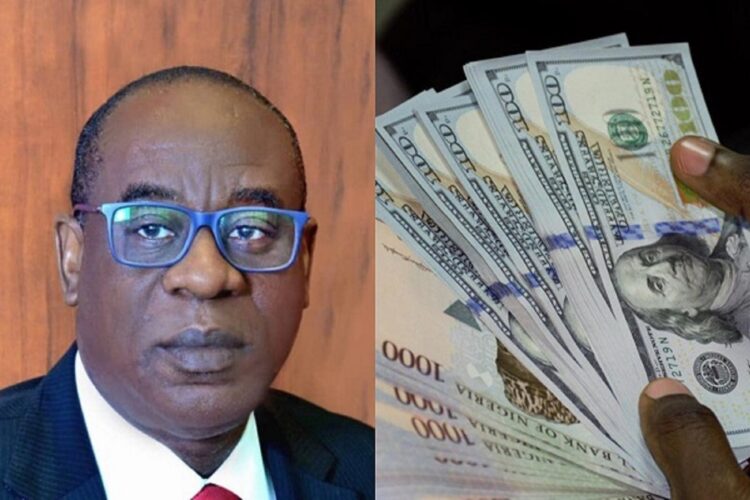

CBN has brought back BDC and introduced a new operational mechanism for Bureau De Change Operations in Nigeria.

Newsonline Nigeria reports that in a bid to enhance the efficiency of the Nigerian Foreign Exchange Market, the Central Bank of Nigeria (CBN) has unveiled a series of operational changes for the Bureau De Change (BDC) segment.

The announcement, made on August 17, 2023, outlines key measures aimed at streamlining and improving the BDC operations.

Under the new framework, the spread on buying and selling by BDC operators is set to fall within a permissible range of -2.5% to +2.5% of the Nigerian Foreign Exchange market window’s weighted average rate from the previous day.

This move is expected to provide more stability and transparency to exchange rate fluctuations, ultimately benefiting both BDC operators and the general public.

Another significant alteration is the mandatory submission of periodic financial reports by BDC operators.

These reports, including daily, weekly, monthly, quarterly, and yearly renditions, are to be submitted through the upgraded Financial Institution Forex Rendition System (FIFX), tailored to meet the specific requirements of each operator. This change aims to enhance oversight and ensure that the BDC sector operates with greater accountability.

The circular further emphasizes that failure to submit accurate returns within the specified timeframe will result in sanctions, potentially leading to the withdrawal of operating licenses. Even in cases where BDC operators have had no transactions during a given period, they are required to submit nil returns, thereby fostering a culture of compliance and thorough record-keeping.

All BDC operators and the public are urged to familiarize themselves with these new guidelines and adhere to them meticulously.

By implementing these measures, the Central Bank of Nigeria anticipates a more robust and well-regulated BDC segment that aligns with broader efforts to enhance Nigeria’s foreign exchange market efficiency.

What this means

In a significant shift, this move marks the re-entry of BDCs into the country’s foreign exchange market.

This move marks a departure from previous policies, including those enacted under the tenure of former CBN Governor Godwin Emefiele, which had temporarily excluded BDC operators from participating in the market.

The new policy signifies a concerted effort by the central bank to reengage BDC operators and reintegrate them into the foreign exchange landscape.