FairMoney has paid over ₦7bn interest to savers as loan disbursements exceed ₦150bn.

NewsOnline Nigeria reports that FairMoney has announced that it disbursed over ₦150 billion in loans over the past year, while also paying more than ₦7 billion in interest to savings customers, underscoring its growing role in Nigeria’s financial inclusion drive.

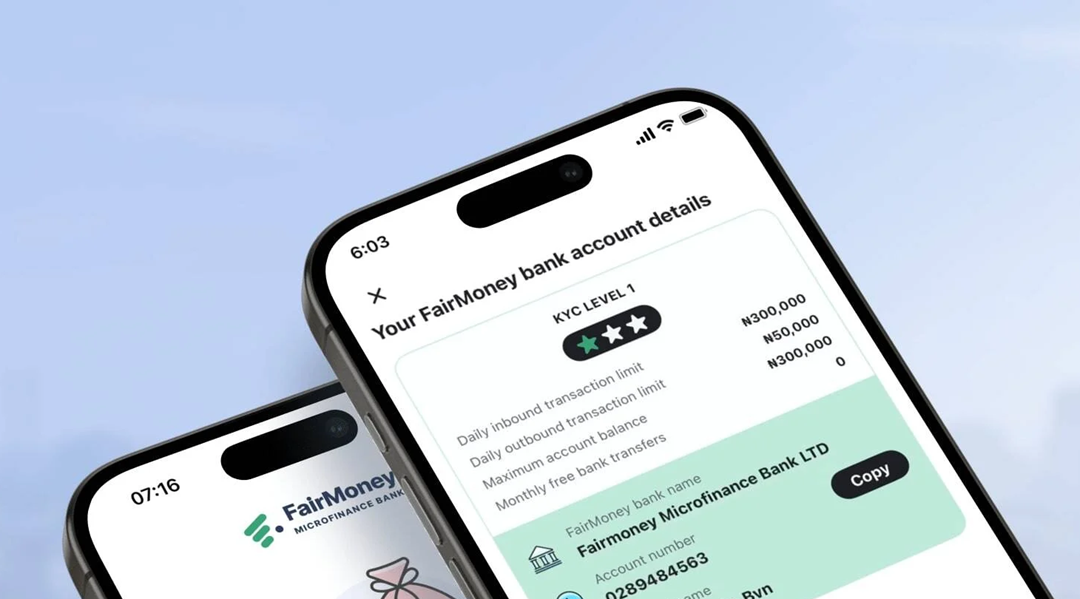

FairMoney Microfinance Bank (MFB), a leading player in Nigeria’s fintech ecosystem, began operations in 2021 as one of the country’s early platforms for fast and accessible credit. Since then, the institution has expanded rapidly, evolving into a fully licensed microfinance bank offering a broad range of financial services.

ALSO: Fidelity Bank Partners Greenfingers to Plant Trees, Clean Up Elegushi Beach in Sustainability Drive

Today, FairMoney provides high-interest savings accounts, fixed-term deposits, current accounts, debit cards, and POS solutions for businesses, all designed to promote financial inclusion through ease of access and competitive transaction rates.

Driving Inclusive Credit Through Technology

As a technology-driven bank, FairMoney leverages artificial intelligence and machine learning to assess customer creditworthiness using alternative data, including smartphone usage patterns and user-provided information. This approach allows the bank to create unique credit scores, enabling fast, collateral-free loans to individuals and small businesses traditionally underserved by conventional banks.

“Our record loan disbursements and savings payouts over the past year are more than just numbers; they reflect our unwavering commitment to supporting Nigeria’s financial ecosystem,” said Henry Obiekea, Managing Director of FairMoney MFB.

“At FairMoney, we understand that access to capital is critical for individuals to thrive and for businesses to scale. Our savings products are designed to deliver inflation-beating returns, ensuring real wealth preservation for both retail and business customers,” he added.

Strong Regulatory Compliance

FairMoney operates as a Central Bank of Nigeria (CBN)-licensed microfinance bank and complies fully with all regulatory guidelines. Customer deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC), while data protection is enforced in line with the Nigeria Data Protection Regulation (NDPR). The bank also maintains bank-grade security standards to safeguard customer information and funds.

Supporting Nigeria’s Cashless Economy

Throughout 2025, Nigeria’s financial sector operated under the CBN’s Payment Systems Vision 2025, which accelerated the country’s shift toward a more inclusive and cashless economy. By October 2025, electronic payment transactions hit record levels, with instant bank transfers accounting for nearly 70% of all e-payments.

FairMoney contributed significantly to this digital growth through widespread loan disbursements and interest payments to savers, strengthening its digital footprint within the financial system.

“Our focus in 2025 was anchored on financial inclusion and a customer-first philosophy built on fairness, empowerment, and trust,” Obiekea said. “As we move into 2026, we remain committed to driving sustainable growth and resilience across Nigeria’s financial landscape.”