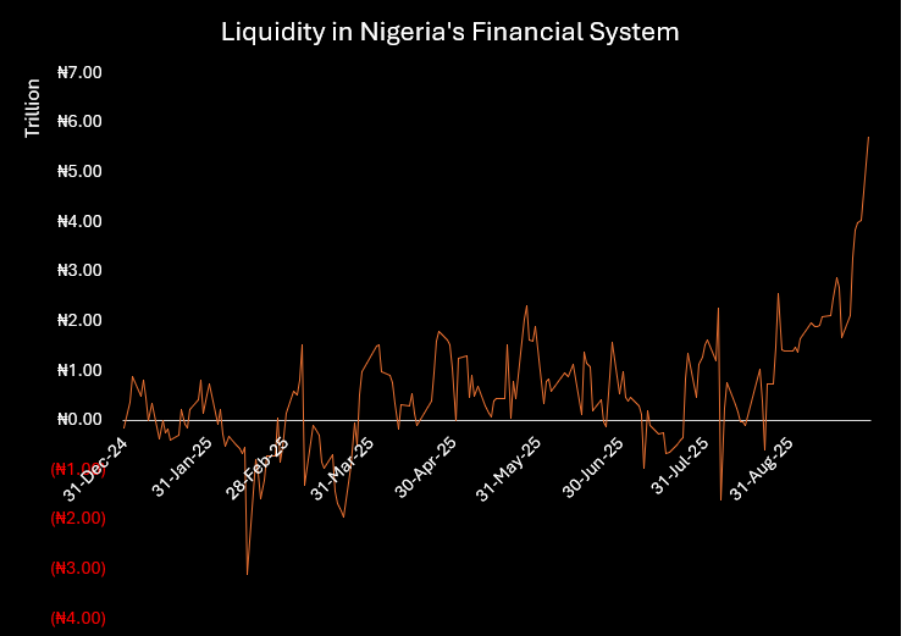

Nigeria’s Financial System Liquidity has hit record ₦5.73 trillion after CBN Policy Shift.

NewsOnline Nigeria reports that system liquidity in Nigeria’s financial market surged to an unprecedented ₦5.73 trillion on Monday, up from ₦4.02 trillion last Friday, following fresh monetary policy adjustments by the Central Bank of Nigeria (CBN).

At its 302nd Monetary Policy Committee (MPC) meeting, the CBN cut the Monetary Policy Rate (MPR) by 50 basis points to 27% which was its first reduction since November 2024. The apex bank also narrowed the Standing Facilities corridor to +250/-250bps around the MPR from +500/-100bps, a move that has fueled massive placements in the Standard Deposit Facility (SDF), which hit ₦5.39 trillion on Monday alone.

ALSO: Court Reverses Teleology Forfeiture, Slams EFCC for Concealing ₦55bn Keystone Bank Judgment

The shift comes amid moderating inflation, as headline inflation eased for the fifth straight month to 20.12% in August 2025. The moderation gave the MPC room to loosen policy slightly to stimulate growth and ease liquidity pressures.

Since the MPC announcement, system liquidity has more than doubled from ₦2.12 trillion last week to ₦5.73 trillion, with most inflows channeled into the SDF. The SDF, a key liquidity tool, allows banks to deposit excess cash with the CBN at an interest rate, reducing exposure to risky lending while stabilizing short-term market conditions.

Money Market Reaction

The liquidity surge has driven down interbank lending rates to their lowest levels in nearly a year. On September 24, the Open Buy Back (OBB) rate fell to 24.5%, while the overnight rate eased to 24.88%—the lowest since November 2024.

Abigael Kazeem-Adeshina, Research Analyst at Norrenberger Financial Group, noted that the CBN is walking a tightrope—loosening rates in line with expectations while sterilizing excess liquidity to control inflation, even after lowering the Cash Reserve Ratio (CRR). She added that another rate cut could follow in November if inflation continues to ease in September and October.

Bottom Line

The CBN’s latest measures have unlocked record liquidity in the banking system, underscoring commercial banks’ preference for safe returns through the SDF. While this supports monetary stability and curbs inflationary risks, much of the liquidity remains trapped at the CBN—limiting immediate credit expansion to the real economy.