N80b USSD debts weaken digital channels as new naira notes arrives – Guardian Reports

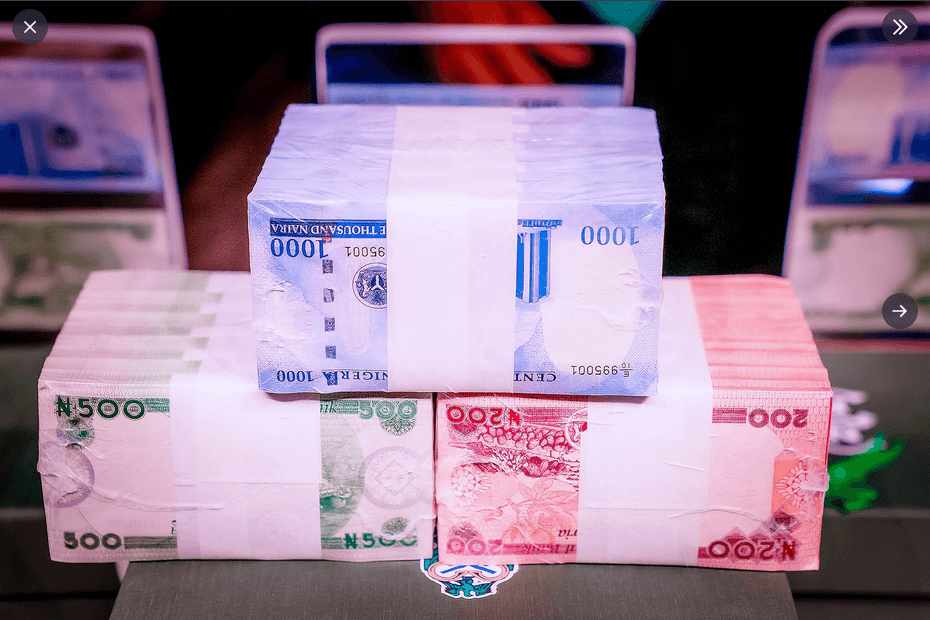

Amid mixed reactions, Nigerians will, for the first time, today, exchange the redesigned N200, N500 and N1,000 banknotes aimed at drastically reducing volume of cash among members of the public.

However, low infrastructure, poor network connectivity and unresolved Unstructured Supplementary Service Data (USSD) debts owed telecoms operators by banks and other financial institutions may pose challenges for the policy ahead of expected surge in digital payment.

Also: New Naira Notes: EFCC Hails CBN, Moves To Clampdown On Currency Hoarders

The Guardian gathered that USSD debt surpassed N80 billion in the last six months, a huge threat to mobile money, which transactions in the country rose to N8.06 trillion, last year, from N3.05 trillion in 2020 and are expected to play a huge role in the new CBN directive.

Besides, stakeholders are worried about lack of infrastructure to drive the new policy, even though telecommunications operators have allayed fears in some quarters, saying all that is needed is having current telecoms infrastructure protected.

The reissuance provides Central Bank of Nigeria (CBN) a rare opportunity to claw back control in circulation of the top two bills – N500 and N1,000 – which have been targets of counterfeiting syndicates and corrupt public officials.

About 85 per cent of the N3.2 trillion currency in circulation is not accessible to banks. And a large chunk of the N2.7 trillion outside the banking system is made up of N500 and N1,000, according to those familiar with the currency management challenge of the apex bank.

While the three redesigned notes will be available in banks from today, there are indications the volume of N500 and N1,000 issued will be restricted by the CBN. The apex bank is more inclined (in its actions) to an argument in support of the top notes as a store of value and not transactional.

A recent cash withdrawal limit directive of the bank, which has pit the regulator against the National Assembly, is illustrative of the likelihood that the large notes will be limited in supply. A clause of the circulation restricts ATM payment to N200, effective January 9.

But some members of the parliament have faulted the policy on the excuse that small businesses would be stifled and that the country is least prepared for such an aggressive cashless policy implementation.

Today, CBN Governor, Godwin Emefiele, or his representative, will be defending the content of the policy before the House of Representatives. The lawmakers had ordered that the policy, which is yet to take effect, be put on hold until they have opportunity to interrogate the regulators.

The policy places N100,000 and N500,000 weekly cash withdrawal limits on individuals and corporate entities, respectively. Daily withdrawals at ATMs are reduced from N150,000 to N20,000, with depositors encouraged to use electronic channels and eNaira, the country’s central bank digital currency (CBDC).

Regardless of the lawmakers’ position, Emefiele said the policy, which kicked off in 2012, and only recently reactivated, would go on with the original timeline. In the past 10 years, he said, Nigeria has had the opportunity of growing support infrastructure to enable electronic payment, a model that is expected to rein in corruption and multiple cash management challenges.

“I think it’s important for me to say that the cashless policy started in 2012. But on almost three to four occasions, we had to step down the policy because we felt there is a need for us to prepare ourselves and deepen our payment system infrastructure in Nigeria.

“Between 2012 and 2022, almost 10 years, we believe that a lot of electronic channels have been put in place that will aid people in conducting banking and financial service transactions in Nigeria.

“And we think Nigeria, as the biggest economy in Africa, needs to leapfrog into the cashless economy. We cannot continue to allow a situation where over 85 per cent of the cash in circulation is outside the bank. More and more countries that are embracing digitisation have gone cashless,” the governor said at a media briefing during a visit to President Muhammadu Buhari in his hometown in Katsina.

Speaking with The Guardian, yesterday, a former presidential candidate and economist, Tope Fasua, said the cash restriction and naira redesign policies “go beyond monetary policy” into the realm of corruption and anti-money laundering. He added that the mind of the President, who has thrown his full support behind the CBN, is made up to continue with the programme, damning any consequence.

Currency redesign sits squarely in the office of the CBN Governor. But the law requires that he gets the approval of the President.

Earlier, Minister of Finance, Budget and National Planning, Zainab Ahmed, dissociated from the redesign policy and queried its timing. But the President responded, saying he had given a written approval as required by the law.

Fasua said the cashless move would not only redeem the naira, which has faced all manner of abuse in recent years but also align with global trend. He observed that knocks coming from the political elite, including lawmakers is understandable.

But Dr. Muda Yusuf, a former director general of the Lagos Chamber of Commerce and Industry (LCCI) and founder of the Centre for Promotion of Private Enterprise (CPPE), warned that cash restriction would have grave consequences for the operations of small and medium enterprises (SMEs) and the economy at large. He noted that the CBN is unduly fixated on currency in circulation, which has crossed N50 trillion.

Yusuf, who spoke at a Twitter Space organised by The Guardian, also argued that the ratio of currency in circulation to the country’s GDP is far less than those of other economies even at similar levels of growth with Nigeria, wondering why it has become a major problem. He charged national economic managers to pay more attention to real challenges confronting the economy and allow electronic payment to evolve naturally.

On the readiness of banks to start giving out the new notes, CBN’s Director, Corporate Communication, Osita Nwanisobi, urged depositors to “visit your banks” today.

Speaking with The Guardian, the Chairman, Association of Licensed Telecoms Operators of Nigeria (ALTON), Gbenga Adebayo, said the USSD payment issue has not been resolved and it is a significant threat to mobile money.

Adebayo said though, “we could say USSD is not the same as mobile money, it is a critical aspect of digital payment. This issue of debt on USSD is a significant elephant in the room. If the matter is not resolved, it will escalate. And when that is done, it becomes a major issue between the telcos and other sectors.”

According to him, telcos may stop providing services to debtor banks, “and it will affect the entire ecosystem. So, there is a conversation that needs to be held around the fragility of the financial sector in relation to the debt some of the banks and finance companies owe telcos on USSD.”

The ALTON chairman, who confirmed that the USSD debt is well over N80 billion, said the sector has the needed infrastructure, to some extent, and is ready to support the banking sector for the expected traffic coming to digital platforms.

He said operators would continue to provide services on a non-discriminatory basis across the sector.

“You know the infrastructure that was connected before is now being connected with fibre optics. Several 2G sites (a few that are left) are going down, more networks are now on 3G. Lots of them have been upgraded to 4G. So, with the progress we have made on our side, as an industry, there shouldn’t be a problem of being able to carry the load capacity required by the bank. So, that is not a problem!

“The focus should be the protection of these infrastructure. That is why we have been clamouring for the Critical National Infrastructure protection law to protect our infrastructure in the sector. Fibre cuts are on the increase! Most cuts are as a result of willful damage, most times, by government contractors. So, where we don’t protect the infrastructure that supports the economy, that is a risk. And that risk is to the extent that quality of service can continue to be affected if we don’t deal with these issues of protecting telecoms infrastructure.

“So, on one hand, while we guarantee capacity availability, damage to infrastructure is not in our control. We can only call on the government and other critical stakeholders to take joint ownership and support the infrastructure that protects all of us.”

Indeed, unlike in other climes, especially in Africa, where mobile money has thrived, in Nigeria, the process has suffered snail-speed development, despite the country being the nation with the highest number of mobile phone penetration in the region.

Mobile money is an electronic wallet service. This is available in many countries and allows users to store, send, and receive money, using their mobile phone. Safe and easy electronic payments make mobile money a popular alternative to bank accounts. It can be used on both smartphones and basic feature phones.

The Guardian checks showed that since the telecoms revolution started in Nigeria over two decades ago, the telecoms sector can boast of 320 million connected telephone lines, out of which 215 million have been active, yet the mobile money sub-sector has not really gained expected traction compared to other climes.

Out of these telephone figures, October 2022 statistics from the Nigerian Communications Commission (NCC) showed that MTN had 83 million telephone lines on its network with 38.8 per cent penetration; Globacom is next with 59 million users and 27.8 per cent nationwide reach. Airtel is third with 58.6 million subscribers and 27.4 per cent penetration, while 9mobile has 12.7 million customers and 5.9 per cent penetration.

Also, despite Nigeria having more banking agents today, compared to the last 10 years, the country is still behind its sub-Saharan African (SSA) peers, when it comes to mobile money adoption.

For instance, in Ericsson’s Consumer and Market Insight report, ‘Mobile Financial Services on the Rise’, out of the six countries surveyed in the region in 2021, Nigeria only outperformed Ethiopia’s eight per cent mobile money usage rate.

Although Nigeria made progress from the three per cent mobile money adoption rate in 2015, its 30 per cent in 2021 lagged behind Ghana’s 90 per cent, Angola’s 47 per cent, Ivory Coast’s 79 per cent and Senegal’s 75 per cent.

While the Global System for Mobile telecommunications Association (GSMA), global industry organisation, describes SSA as “the epicentre of mobile money” due to the exponential growth of registered accounts in the region, Nigeria is yet to catch up with its peers, as 70 per cent of the country’s consumers are either unaware, familiar, or do not use mobile money.

GSMA reported that SSA countries accounted for the largest share of mobile money transactions last year, as $490 billion was processed.

The body in its ‘State of the Industry Report on Mobile Money,’ claimed that SSA has continued to lead the rest of the world in mobile money transactions due to increased investment by telecoms operators in the digital banking segment.

Unlike Nigeria, the countries with high mobile money usages are reaping the benefits of an enabling regulatory environment that supports mobile money growth, especially in Kenya, which has remained a reference point in Africa.

Analysts believe mobile money is an obvious channel for Nigerians at the bottom of the pyramid as they adopt financial services for the first time.

The Guardian gathered that up to 25 mobile money operators (MMOs) have been licensed, since the launch of mobile money service in Nigeria in 2009. Despite this large number of MMOs, high mobile phone and SIM card ownership, mobile money uptake and usage are still low in Nigeria.

The CBN issued the Guidelines for Agent Banking and Agent Banking Relationships in Nigeria in 2013 and the Operating Framework for Super Agent in 2015, in its bid to deepen the uptake of mobile money and agent banking products. However, the uptake of mobile money and agent banking services remains low in Nigeria.

But with the four major mobile networks in Nigeria now having payment service bank (PSB) subsidiaries, analysts say that there is hope for that segment of the market.

Specifically, 9mobile has 9PSB Limited; Airtel Africa has Smartcash PSB Limited; Globacom Limited has MoneyMaster PSB Limited; and MTN Nigeria has MoMo PSB Limited.

Essentially, PSBs are mobile money operators that can deploy automated teller machines (ATMs) or gagged microfinance banks — that must operate mostly in rural areas and unbanked locations targeting the financially excluded but can’t give loans.

Speaking on the matter, the Chairman, Association of Licensed Mobile Payment Operators (ALMPO), Jay Alabraba, said the body definitely sees the long-term benefits of the cash withdrawal policy announced by the CBN Governor, especially as it aligns with its goal of deepening financial inclusion and reducing cash use in the economy.

Alabraba said if all stakeholders are engaged and working together, the policy should support broader uptake of digital financial services, adding that it will force more pockets of the informal sector into the formal economy, which is a good thing for consumers, businesses and the Nigerian economy overall.

However, he said: “We are eager to engage further with the CBN regarding concerns on how the policy negatively impacts mobile money agents and agent network operations in general. The fact is that mobile money agent networks have bridged the cash-to-digital gap and contributed significantly to commerce and financial inclusion in Nigeria. And there are a lot more future gains to be achieved by leveraging these networks.”

On his part, Executive Secretary of the Association of Telecommunications Companies of Nigeria (ATCON), Ajibola Olude, said there are several opportunities for mobile money operators from the new policy.

Olude said the entire bank customers would be constrained to download mobile money apps and traditional bank apps to be able to perform their banking transactions.

While admitting that the opportunity would put pressure on Nigerian telecoms infrastructure because the number of people that would use the infrastructure would increase, Ajibola said he expects CBN to support the telecoms industry by disbursing long-term loans to operators at a single-digit rate, so that they can take services to areas they consider less viable, commercially.

The ATCON Executive Secretary appealed to the traditional banks to see PSB as a partner in deepening the policy on financial inclusion, stressing that CBN needs to embark on vigorous enlightenment about PSB, especially in the rural areas.

According to him, there must be truce between banks and telecoms operators on the USSD crises currently rocking the industry.

On this, Ajibola said: “It is sad that the banking sector is yet to remit the money due to telcos from USSD charges despite several meetings.”

According to him, the new policy would help drive the cashless policy but CBN needs to make some necessary adjustments in the area of the withdrawal policy, “For example, many of our youths have taken up POS business and with this policy, they might be pushed out of the business.”

Meanwhile, Resource Centre for Human Rights and Civic Education (CHRICED) said, having closely monitored public debate created by Central Bank of Nigeria’s (CBN) regulation on cash withdrawal limits for individuals and corporations, it is evident that the apex financial institution has once again acted in a hasty and ill-conceived manner.

In a statement by Executive Director, Dr. Ibrahim M. Zikirullahi, yesterday, CHRICED said: “In a country where the vast majority of people struggle to earn a living in the informal sector, the policy to restrict cash withdrawals amounts to an attempt to impoverish even more citizens.

“Also, the majority of poor and unbanked Nigerians would be struck even harder, as smartphones are the only common means to engage in digital transactions, such as cashless payments. Those who cannot afford smartphones will be left behind.

“The implication of the CBN’s cruel policy is that electronic payments are not as secure as they would have the gullible believe, at least, not in Nigeria. Without the proper infrastructure, a cashless system exposes citizens to hackers and robbers of the electronic world, who can drain one’s account with no other way to spend money. Glitches, outages, and innocent mistakes can all cause problems and leave one bankrupt.”

CHRICED noted that in light of the latest National Bureau of Statistics (NBS) report indicating 133 million Nigerians live in multidimensional poverty, well-intentioned government institutions should examine policy choices that will stimulate the economy and put money in the hands of citizens.

“In a country where millions of citizens are still reeling from the devastating economic realities imposed by the COVID pandemic, in terms of livelihoods and jobs, it defies belief that a government, unable to provide any form of economic stimulus, would even consider an idea that would result in more people losing their jobs.

“It is disheartening that the CBN does not care about the millions of people whose livelihoods will be destroyed as a result of the apex bank’s rash and harebrained experimentation. It is strange and completely repugnant that a government that implemented policies that pushed millions of Nigerians into the trap of poverty, would be hell-bent on pushing through harsher policy options when it should be thinking of how to give succour to the long-suffering people of this country,” CHRICED said.

The Centre explained: “A cashless society runs on digital technology. More than half of Nigeria’s population is still without electricity. Even major cities and capitals are daily experiencing epileptic power supply, and due to fuel scarcity and other attendant issues, the cost of running a generator is extremely high.

Therefore, while CHRICED is not opposed to a cashless transaction system in Nigeria, we are convinced that this can only happen if Nigeria gradually develops the infrastructure needed to support such a system.

“A country – with mass illiteracy, and millions of unbanked citizens, which continue to face infrastructure challenges, such as erratic power supply and low internet penetration – cannot simply wake up one morning and force everyone to adopt a cashless system that lacks the necessary infrastructure.

“In many far-flung rural communities, which are cut off from all the trappings of modernity, a policy, like this, would be the source of untold suffering and starvation. In many such communities, this policy will be a matter of life and death.

“The limit being placed on cash withdrawal could be the determining factor in whether someone in a critical medical emergency lives or dies. In a country, where even medical facilities would not admit or treat a patient until a ‘cash deposit’ is made, there can be no mistaking the fact that the CBN has not done a proper situational analysis before trying to push the country and its economy down this path.”

CHRICED said it “believes this policy demonstrates that the Godwin Emefiele-led CBN has never had the best interests of ordinary citizens in mind, since his appointment as Governor of the CBN. In fact, this policy calls to question his qualifications as a banker and economist.

“To all intents and purposes, Emefiele is more concerned about putting more money in the coffers of the banks. The import of this withdrawal limit policy is that the banks, who are already neck-deep in the despicable business of fleecing Nigerians of their hard-earned money, will now have the free space to continue with their pilfering of money kept in their custody through arbitrary charges and deductions.

“This implies that while Nigerians will be groaning under the burden inflicted by this policy, the banks will be feasting on the sweat of the people. This kind of despicable monetary policy is not acceptable to the Nigerian people, and therefore stands rejected.”