Most Valuable Commercial Banks In Nigeria as of January 2022 has emerged.

NewsOnline reports that Zenith Bank, GT Bank, and Stanbic IBTC Holdings retained the top spot for most valuable commercial banks in Nigeria as of the end of January 2022, as the market capitalization for the thirteen listed Nigerian banks increased by N194.5 billion in the review month.

ALSO: JAMB UTME Result Portal: How To Check JAMB Result In 2022

This is according to data collected by Nairalytics, the research arm of Nairametrics from the Nigerian Exchange Group (NGX).

The banking sector market capitalization rose from N6.35 trillion recorded at the end of 2021 to close at N6.73 trillion in January 2022, indicating a 3.1% month-on-month increase. Similarly, the NGX banking index gained 8.7% to close at 441.4 index points in the review month.

Also, the All-Share index of the stock market rallied 9.15% in January, closing at 46,624.67 points while the market capitalization closed at N25.1 trillion.

According to Nairametrics tracker on the market capitalization of listed banks, Zenith Bank gained the highest in the review month, recording a N28.3 billion in its market capitalization, while Wema Bank recorded the highest boost in terms of percentage relative to the previous month.

Top banks by market value

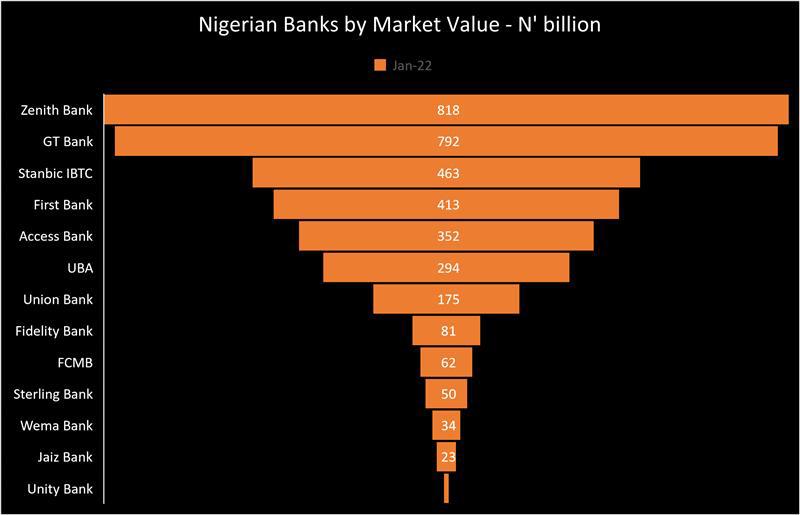

Zenith Bank maintained the top spot with a market valuation of N817.9 billion, closely followed by GT Bank with a market cap of N791.7 billion. Stanbic IBTC with N463.2 billion valuation stands in third place, while First Bank’s valuation stood at N412.8 billion as of the end of January 2022.

On the flip side, Unity Bank has the lowest market capitalization with N5.96 billion, following a N351 million decline compared to the previous month. Jaiz Bank also followed with a valuation of N23.5 billion, albeit a N4.1 billion gain in the month of January 2022.

Others on the list include Access Bank with N351.9 billion, UBA (N294.1 billion), Union Bank (N174.7 billion), Fidelity Bank (N81.4 billion), FCMB (N61.9 billion), Sterling Bank (N49.8 billion), and Wema Bank with valuation at N33.9 billion.

Most improved banks

Zenith Bank also led the list of most improved banks in terms of monetary value with a gain of N28.3 billion, owing to the 3.58% increase in its share price to close the month at N26.05 per share. GT Bank followed with a market appreciation of N26.49 billion as its share price rallied by 3.46% in the month under review.

Access Bank recorded a gain of N21.3 billion, while UBA rallied by N18.8 billion to close at N294.1 billion in January 2022.

On the other hand, Wema Bank grew its valuation by 22.2% in the month under review, representing the most improved bank in terms of percentage relative to the previous month, followed by Jaiz Bank, which gained 21.4% and Sterling Bank with a gain of 14.6% in the month under review.

What you should know

- The Nigerian stock market has received positive reception to the new year as investors driven by buy-sentiment, move their monies to equities with the banking sector receiving a chunk of these investments, evidenced by the performance of the banking index.

- The rally could be attributed to the possibility of investors making extra income from dividend-paying companies as the public prepare for the release of their 2021 full year financial statements. A major incentive for investors to buy shares of companies with history of paying dividends.

- It is imperative to add that the banking sector accounts for 26.8% of the total equity’s market capitalization of the Nigerian stock market. It is worth noting that Ecobank Transnational Incorporated (ETI) was not included in this report.