President Tinubu administration is set to borrow fresh N1.76trn amid escalating debt crisis in Nigeria.

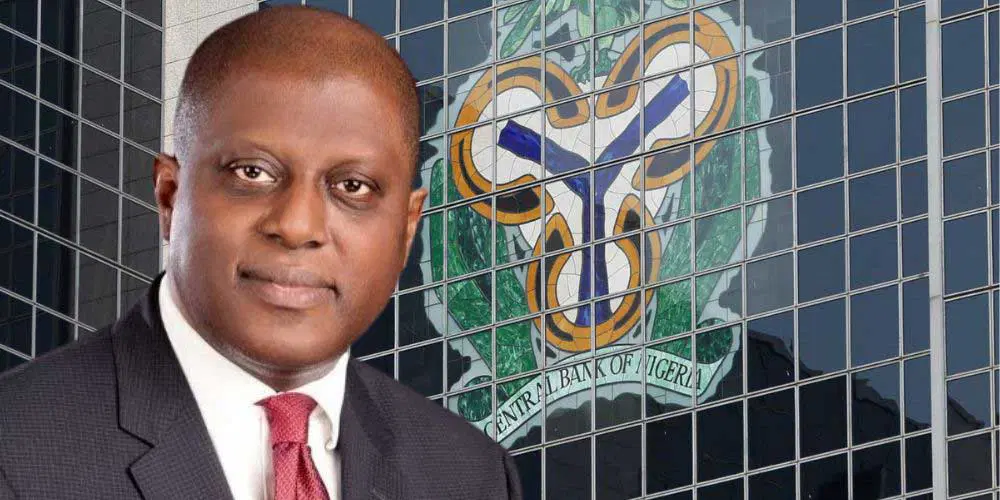

In a move that underscores Nigeria’s deepening debt woes, President Bola Tinubu Federal Government is set to borrow an additional ₦1.76 trillion through the sale of Treasury Bills (TBs) in the third quarter of 2025 (Q3’25), according to a newly released borrowing plan by the Central Bank of Nigeria (CBN).

The figure marks a 12.8% year-on-year increase from the ₦1.56 trillion borrowed during the same period in 2024, a worrying indicator of the country’s continued reliance on domestic debt to plug fiscal gaps.

ALSO: NNPCL CEO, Bayo Ojulari Hints at Possible Sale of All Nigerian Refineries

The CBN’s Treasury Bills Issue Programme, published Wednesday, outlines how the apex bank will borrow on behalf of the federal government between July 2 and September 24, 2025, amid growing concerns over Nigeria’s escalating public debt burden, which now exceeds ₦97 trillion.

Treasury Bills, short-term government securities with maturities of less than one year, are also used by the CBN to regulate liquidity in the economy. However, analysts say the increasing volume of TBs points to Nigeria’s intensifying fiscal distress.

Breakdown of the Borrowing Plan:

-

July 2025:

-

₦540 billion total

-

₦150bn (91-day), ₦40bn (182-day), ₦350bn (364-day)

-

-

August 2025:

-

₦450 billion total

-

₦110bn (91-day), ₦50bn (182-day), ₦290bn (364-day)

-

-

September 2025:

-

₦770 billion total

-

₦80bn (91-day), ₦140bn (182-day), ₦550bn (364-day)

-

Economists warn that while Treasury Bills offer a way to manage short-term liquidity, Nigeria’s increasing debt service obligations, consuming over 90% of federal revenue, risk pushing the country into a debt trap.

NewsOnline Nigeria reports that the 364-day bills alone account for ₦1.19 trillion, representing nearly 68% of the total borrowing plan, suggesting the government’s preference for longer short-term instruments amid tightening fiscal space.

With foreign borrowing options narrowing due to rising global interest rates and Nigeria’s credit rating concerns, experts say the government is falling back heavily on the domestic debt market, which could crowd out private sector access to credit and slow economic growth.

As the CBN proceeds with its debt issuance, the development highlights Nigeria’s urgent need for fiscal reforms, revenue diversification, and spending discipline to avert a full-blown debt crisis.