EFCC has sued Chinese Directors and Company over alleged N1.2 billion tax evasion.

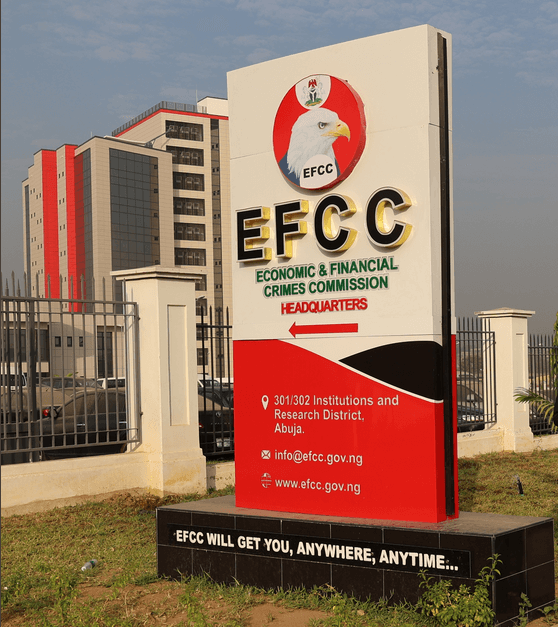

NewsOnline Nigeria reports that the Economic and Financial Crimes Commission (EFCC) has sued an aluminium coil company, SSL Industry Company Limited and two of its Chinese directors, Liu Qiang and Shi Shuai, over alleged N1.2 billion tax evasion.

The allegations, contained in EFCC’s charge sheet marked FHC/ABJ/CR/30/2024, accused the defendants of failing to deduct and pay the Federal Inland Revenue Service(FIRS), its due Value Added Tax(VAT).

The alleged tax default was said to have happened between 2019 and 2021 despite the company’s operations in the country.

ALSO: EFCC To Arraign Former Aviation Minister Hadi Sirika Over N2.7bn Fraud

Also joined in the case is Barrister Babatunde Ayeni, whom the EFCC identified as the company’s lawyer.

The anti-graft’s lawyer, Samuel I. Chime Esq, alleged that Ayeni delivered false income tax returns on behalf of the company, to relevant bodies.

The suit is amid the federal government’s prosecution of alleged tax evasive foreign companies including Binance Limited.

In the charge sheet seen by NewsOnline Nigeria, the EFCC asked Justice Inyang Ekwo to convict the defendants for tax evasion.

The charge reads,

“That you SSL Industry Company Limited, Liu Qiang (being the Managing Director of SSL Industry Company Limited), and Shi Shuai (being the director of SSL Industry Company Limited) between 2019 to 2021, in Abuja within the jurisdiction of this Honourable Court, being obliged by section 16/1 (a) of the Value Added Tax Act failed to deduct and pay to the Federal Inland Revenue Service within 30 days from the date the Value Added Tax became due for deduction, and thereby committed an offence contrary to section 40 of the Federal Inland Revenue Service Act 2007 and punishable under section 40 of the same Act.

“That you SSL Industry Company Limited (being in the business of sale of aluminium coil) Liu Qiang (being the Managing Director of SSL Industry Company Limited), and Shi Shuai (being the director of SSL Industry Company Limited) between 2019 to 2021, in Abuja, within the jurisdiction of this Honourable Court, evaded the payment of the Value Added Tax Act in the sum at N1, 217, 789, 058 to the federal inland Revenue Service, and thereby committed an offence contrary to section 28 of the Value Added Tax Act and punishable under section 26 of the same Act.

“That you SSL Industry Company Limited, Liu Qiang (being the Managing Director of SSL Industry Company Limited), Shi Shuai (being the director of SSL Industry Company Limited) and Babatunde Ayeni (Trading under the name and style of Babatunde Ayeni & Co), sometime in 2021, in Abuja within the jurisdiction of the Honourable Court, made signed and delivered to the Federal inland Revenue Service an audited financial statement which is false as to the object of the company and the turnover and thereby committed an offence contrary to Section 42(1) of The Federal Inland Revenue Service Act 2007 and punishable under section 42 (3) of the same Act.

“That you Babatunde Ayeni (Trading under the name and style of Babatunde Ayeni & Co), sometime in 2021 in Abuja within the jurisdiction of this Honourable Court, aided SSL Industry Company Limited to make or deliver a false audited financial statement/income tax returns under the Companies Income Tax Act and thereby committed on offence contrary to section 94 (1) of the Companies Income Tax Act 2007 and punishable under section 14 of the some Act.

What transpired in court

Today was fixed for the arraignment of the defendants by the EFCC.

But none of them were in court to take their plea.

Justice Ekwo further adjourned the case to October 22, 2024 for arraignment.

Nairametrics gathered that the two directors had absconded and departed to China and there are moves to extradite them to face trial.

More insights

- Tax evasion is a serious offence in the Nigerian jurisprudence.

- Section 40 of the FIRS Act frowns on the non-deduction and non-remittance of taxes while recommending penalties and imprisonment terms for defaulting entities.

- While tax issues are within the purview of the FIRS, the EFCC can prosecute all forms of financial crimes including tax default.

- As of 2018, the FIRS realized that the majority of the major organizations in Nigeria that were allowed to do self-assessment did not truthfully declare or pay the taxes that were due.