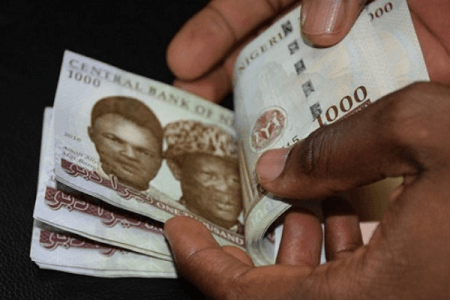

Naira has been predicted to face massive pressure on low oil output and rising interest rates.

NewsOnline reports that Economists have said the devaluation of Nigeria’s currency, naira, is inevitable in 2022 as lower oil production puts pressure on the nation’s reserves.

ALSO: Full List Of 2022 CBN Approved Bank Charges in Nigeria

The price of Bonny Light, Nigeria’s premium oil grade, has surged to $88 per barrel, the highest since 2014, but Africa’s biggest economy has missed out on an opportunity to improve its earnings as oil production falters.

Nigeria only produced 1.19 million bpd in December, a decline of 78,000 barrels compared with the previous month, according to the Organisation of Petroleum Exporting Countries (OPEC) – the lowest since 2016.

“Clearly, the FX market is constrained although we are seeing some positive development lately with higher oil prices, Nigeria may consider resetting currency and can see 10 percent depreciation from 414 to around 450-460 in 2022,” Abhilash Narayan, a senior investment strategist at Standard Chartered, said during a webinar themed ‘Global Market Outlook-Africa.’

The Central Bank of Nigeria (CBN) has devalued the naira three times since March 2020, as lower oil income weakened the nation’s reserves. Last year, the currency was devalued 8.6 percent to N414/$.

“Given our expectations that the accretion to the FX reserves would be weak in line with the low crude oil production levels, it suggests that the ability of the CBN to defend the naira is limited to the one-off inflows from recently issued Eurobond and the IMF’s SDR,” analysts at Cordros Securities said.

“Accordingly, the CBN would need the support of foreign investors to boost FX liquidity over the medium term. Overall, our baseline expectation is that the CBN will devalue the naira between N440/$ and N460/$ at the I&E Window,” the analysts said.

ALSO: CBN Releases Export/Import E-Invoicing Guidelines

The International Monetary Fund (IMF) in a recent report advised emerging economies including Nigeria to allow their currencies to depreciate in response to tighter funding conditions and an imminent policy tightening by the Federal Reserve Bank of the United States.

Steve Brice, the chief investment officer at Standard Chartered, said interest rates would get higher in the US, but not as high as was being speculated.

“We also see interest rates going higher in countries like Ghana, Kenya, and Zambia, but Nigeria will be able to hold the line and support recovery despite weak naira,” Brice said.

The international credit rating agency, Fitch Solutions, has also projected that Nigeria’s naira will weaken in 2022 to an average of N428/$ on weak reserves.

“The naira will face various pull forces during the year. On the one hand, foreign currency borrowing and increased crude oil revenues will keep the foreign reserves above $35 billion and give the CBN some ammunition to defend the naira,” according to Ikemesit Effiong, head of research, SBM Intelligence.

“On the other hand, increased demand from politicians mopping up dollars ahead of the elections, foreign investors seeking to repatriate their funds ahead of the elections, and manufacturers seeking to import materials will be the main demand drivers. Thus, we expect some devaluation of the official rate to about $1/N450,” Effiong said.

According to Yvonne Mhango, sub-Saharan Africa economist at Renaissance Capital, “The naira at the investor and exporters (I&E) FX window is 13 percent overvalued, on our real effective exchange rate (REER), and has a fair value of N473/$1. We see the I&E window FX rate at N482/$1 in 2022.”

The bleak outlook for the naira does not stop there.

Analysts at Economist Intelligence Unit (EIU) also stated that cautious naira depreciation against the US dollar would be permitted in 2022-24 to prevent major imbalances.

“However, this will be gentle compared with adjustments in 2020-21 as the current account returns to surplus and external liquidity conditions become more favourable, with a rate of N444.7:$1 expected at end-2024 (with an average rate of depreciation of 3.5% each year). Substantial devaluations are expected in 2025-26 as oil prices slide, underlining historical overvaluation,” the analysts noted.

The naira exchanged at ₦416.33 per dollar on Friday at the official market, according to data from the trading platform, FMDQ.