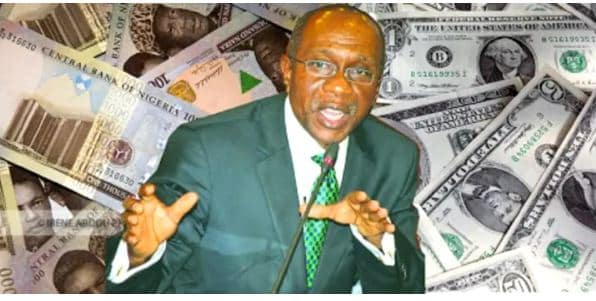

Again, CBN has insisted BDC ban has helped naira Stabilise.

Newsonline reports that the termination of FX allocation to Bureau De Change operators, according to the Central Bank of Nigeria (CBN), has helped the Naira remain stable at the Investors and Exporters Window (I&E).

However, there has been a significant fall of the currency in the black market since the BDC ban policy.

The Governor of the CBN, Mr Godwin Emefiele, who was represented by Mr Edward Adamu, Deputy Governor, Corporate Services, made the announcement during the CBN’s 32nd Seminar for Finance Correspondents and Business Editors on Thursday in Akure, Ondo.

At the official Investors and Exporters (I&E) window, the naira and the US dollar exchange rate remained unchanged at N417/$1 from the previous day.

The parallel market witnessed a market depreciation, with the exchange rate selling for an average of N583/$1, down 0.87 percent from the previous session’s rate of N578/$1. According to information collected from BDCs in Nigeria, this is the case.

When the CBN prohibited BDCs on July 27, 2021, the exchange rate was N500/$1. Now, the Naira appears to be sliding near N590, showing more ground lost after the BDC ban.

Backstory

- At the 137th Monetary Policy Meeting on July 27, 2021, the Central Bank of Nigeria took an aggressive stance to stop supplying foreign exchange to Bureau De Change operators (BDCs) in order to stop what CBN Governor Godwin Emefiele described as “illegal activities” perpetrated by BDCs when foreign exchange is supplied to them.

- CBN governor’s fundamental concern with BDC operators is that they continue to create fake FX scarcity in order to make “abnormal” profits, posing a risk to the Nigerian financial system.

- Emefiele went on to say that rent-seeking BDC operators are only interested in large margins, dollarization of the Nigerian economy, subversion of the cashless policy, common ownership of several BDC by the same owners to obtain multiple FX, and regrettably, international organization and embassy patronage of illegal FX dealers were all bad for the CBN’s price stability goals.

What the CBN Governor is saying

The CBN boss said, “As a result of our demand management policy, the naira has remained largely stable at the I & E window, particularly since the discontinuation of FX allocation to Bureau De Change operators along with the convergence between the CBN and NAFEX rates. Banks are now able to meet the demands of their customers seeking forex for SMEs, school fees, medical and PTAs,”

- He explained that the Bank set up an Investors and Exporters Window (I&E) to allow for the purchase and sale of foreign currency at market rates.

- The naira maintained relative stability in 2021, according to the CBN, at N411.50/US$ in August but declined to N414.33/US$ in December. The currency rate was N416.98/US$ in February 2022. For a long time, the CBN has used a controlled float exchange rate regime.

- In order to maintain exchange rate stability, the system has attempted to intervene in the market by supplying foreign exchange.

- Emefiele listed other measures taken by the CBN that had yielded results.

- He said that they include partnerships with commercial banks to go after Nigerians who falsely bought dollars under the pretence of travelling abroad and ended up roundtripping.

He said, “The Central Bank of Nigeria had also sanctioned Bureau De Change (BDC) operators for illegal forex trading and discontinued the sale of forex to the Bureau operators in Nigeria. In addition, licensing of new BDCs was suspended. The CBN also introduced the ‘Naira 4 Dollar Scheme’ to encourage diaspora remittances.”

He said that remittance inflows had been supported by the ‘Naira for Dollar’ scheme, and there had been a surge in the inflows.

“It is heartening to note that these policies are yielding positive results in terms of meeting genuine demand for foreign exchange and exchange rate stability,” he said.