Prophet Odumeje has reacted to the lingering naira scarcity, saying Banks will be burnt down by the people in a new prophecy.

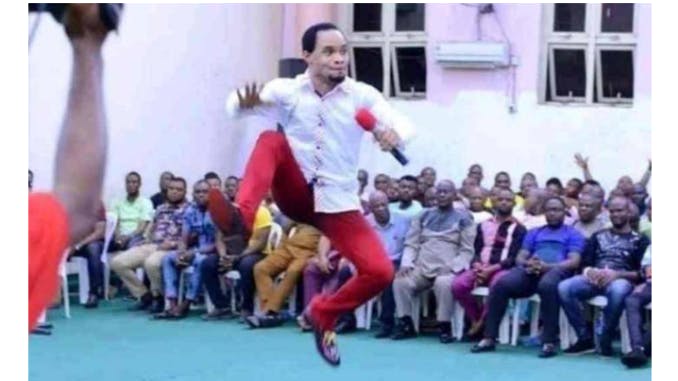

Newsonline reports that the founder of Mountain of Holy Ghost Intervention and Deliverance Ministry, Onitsha, Chukwuemeka Ohanaemere, popularly known as Prophet Odumeje ‘The Lion’, during Sunday service in a video posted on his official Instagram page has foretold danger for Nigeran banks over the lingering naira scarcity across the country.

This online newspaper understands that the Governor of the Central Bank of Nigeria, Godwin Emefiele, on October 26, 2022, announced that new Naira notes would be introduced to replace the current 200, 500, and 1,000 Naira notes.

ALSO: 2023: CDD Urges INEC To Fix Lapses In BVAS Mock Accreditation

According to CBN, the Naira note was redesigned to address the issue of individuals who have made currency fraud their main source of income. People who have hidden money they have stolen, for instance, would either find a way to change it by taking the money out or would not need it given the change in the value of the Naira.

NewsOnline Nigeria recalls that the decision generated a lot of controversy which necessitated the meeting between President Buhari and the CBN Governor, Godwin Emefiele in Daura on Sunday, January 29 where the later after the meeting announced a 10-day extension from January 31 to February 10, 2023.

The new dates also include a grace period of seven days (February 10-February 17, 2023) when Nigerians could return old notes to the CBN.

Speaking in Daura on Saturday, January 28, the President had argued that the FG’s currency swap is not meant to target innocent citizens but corrupt persons and terror financiers hoarding illicit monies.

He also assured Nigerians that the government will ensure that they and their businesses will face no harm from disruptions caused to the entire supply chain arising from the currency swap.

However, NewsOnline reports that the scarcity of the new naira notes has become a thing of concern to many Nigerians, who cannot lay their hands on either the new notes or the old ones.

The commercial and daily life activities across Nigeria came under new pressures, as scarcity of Naira notes worsened amidst equally worsening petrol supply crises, despite the extension of the deadline for acceptance of the old Naira notes as legal tender.

NewsOnline Nigeria’s findings across some commercial centres indicated that rather than softening the pressure on the populace, most people could not access either the old notes or the new ones, throwing commercial and daily life into confusion and agonies.

The commercial banks have stopped dispensing the old notes while they claim the new notes are not sufficient to meet demands either at the Automated Teller Machines, ATMs or over the counters in banking halls.

Though the CBN Governor, Mr Godwin Emefiele had ordered all banks to accept the deposit of old Naira notes at no cost to the depositors and load ATMs with the redesigned banknotes.

The apex bank had stressed that one of the objectives of its currency policy changes which included the imposition of limits on cash withdrawals was to encourage cashless monetary transactions through the various digital channels.

But bank customers that visited various branches of commercial banks across Nigeria lamented that economic activities are affected as traders could not accept transfers for the payment of goods since they cannot get cash from the banks.

Narrating his experience to Vanguard, Mr Duke Akpan, a civil servant said: “Economic activities were paralysed at Ketu market and environs, yesterday, as a result of the unavailability of cash in banknotes. Many buyers, individuals and households did not have adequate cash to pay for essential goods and services, including food items.

“The banks and other financial service providers were unable to address the issues or problems encountered by individuals, households and businesses.

However, a few Points of Sale, PoS, operators, who had limited cash took advantage of the situation to make brisk business by charging a high premiums on cash supply where N100, N500 and N1,000 are charged for supplying N1,000, N5,000 and N10,000 respectively to customers .

Commenting, Mary Eze, said: “At Abule-Ado and Trade fair areas of Lagos, all the banks’ ATMs were empty and were not dispensing. I visited all the banks at Abule-Ado and others at Trade Fair. With one exception, all the banks did not have money to pay either through their ATMs or at the banking hall.

‘‘Unfortunately, the one that was paying, configured its machines to dispense only N1,000 (One thousand Naira) per time. Though it did not get to my turn because of the long queue, customers who made withdrawals while I was at the bank were charged N35.00 on each N1,000 withdrawn.

“So, customers who withdrew N10,000 parted with N350 instead of N35.00 that they should pay in line with the approved bankers’ tariff.”

She further stated that PoS operators around the area that have the money charged customers N1,000 fees for withdrawal or deposit of N10,000 old notes.

A bank customer, who identified herself as Chioma Anene lamented that her visit to all the banks along Okota Road, Isolo area of Lagos yielded no results as she wasted the whole day trying to see if she could get money from any of the banks.

She said that of all the banks she visited in the same area, neither their ATMs nor Over-the-Counter withdrawal was possible.

Narrating her experience, she said: “I left my house very early in the morning to see if I could withdraw money but in the end, I could not withdraw anything.

“I the bank I first visited, the ATM was not dispensing. Inside the banking hall, they told me that they didn’t have cash. A staff of the bank took pity on me and wanted to pay me with N100 notes, but the notes were tattered and would be difficult to spend.”

She said that a visit to other banks nearby yielded the same result, while at one she was told that the bank paid each customer that came to withdraw in the morning N2,000, but as at the time she got there, the bank had stopped disbursing.

Continuing, she said: “While we were still in line at there, the money in the ATM finished. The security man asked us to wait a while for bullion to come. When the bullion eventually arrived, and it was taking too long to load the ATM, I left the bank without getting any money.

“At another bank, the gate man even told me not to bother myself going inside the banking hall because they are not paying,”

She said that all the PoS she visited didn’t have money, while the only one that had old notes demanded N4,000 payment before she could be given N20,000.

Another bank customer located at the same Okota Road, Isolo, said though she was not lucky to make any withdrawal when she visited the bank on Wednesday, February 1, she was told that the bank disbursed old notes between 8am and 10 am and each lucky customer was paid N5,000 of the old notes.

Reacting to the growing tension over the lingering scarcity of the new naira notes which has totally crippled all economic activities across the country, outspoken SouthEast based Nigerian Prophet, Chukwuemeka Odumeje in a now viral video warned that the masses might revolt and burn down banks before Tuesday if the federal government refuses to release people’s money.

He further condemned the new trend of using the naira to buy naira across the country.

Prophet Odumeje Predicts Doom For Nigerian Banks (VIDEO)