The Nigerian Financial Intelligence Unit (NFIU) on Thursday, said cash withdrawal by public officials for any official functions or exigencies shall be illegal from March.

Newsonline reports that NFIU Director/Chief, Mr. Modibbo Hamman Tukur, said the discontinuation of cash withdrawal in naira and foreign denominations from public accounts at federal, state, and local government levels is in compliance with relevant provisions and aimed at confronting terrorism financing and money laundering by public officials.

“Under no circumstance, shall any category of public officers be given a standing or continuous waiver to withdraw cash from any public account in any financial institution or designated non-financial institution.

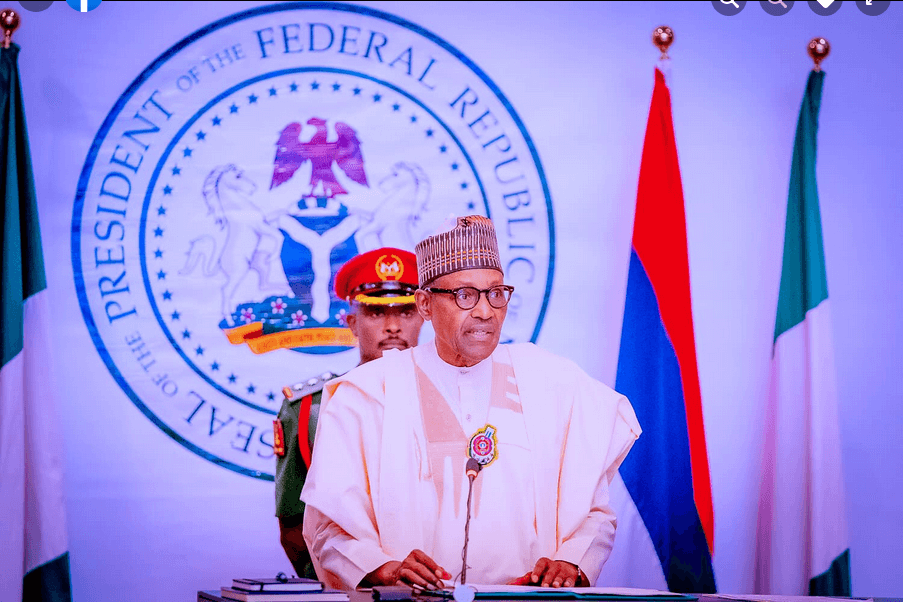

READ ALSO: Incoming President Will Inherit N77trn Debt From Buhari- DMO

“For government exigencies, only the President has the power to grant any waiver to any government official, considering the importance of the situation; either for national security, health, or other important reasons.” NFIU Chief said.

Tukur said the Unit supports the CBN’s circular on cash withdrawal limit which is in harmony with the law, provided in Section 2 of the Money Laundering (Prevention and Prohibition) Act, 2022 (MLPPA, 2022), adding that the new guidelines will support the efforts of the apex bank.

He said the discontinuation of cash withdrawal in naira and foreign denominations from public accounts at federal, state, and local government levels were in compliance with its statutory responsibility under Section 3(1) a – s and Section 23 (2) a of the NFIU Act, 2018, and other provisions under the MLPPA, 2022.

The NFIU chief added that the new guidelines became necessary considering the provisions and enforcement requirements of the law, particularly Sections 2 and 13 of the MLPPA, 2022, Section 26 of the Proceeds of Crime (Recovery and Management) Act, (POCA) 2022, and the CBN circular on the revised cash withdrawal limits, issued pursuant to its powers under the CBN Act, 2007, and Banks and Other Financial Institutions Act, 2020.

Part of the statement added, “by these guidelines, the local government N500,000 cash withdrawal limit with regards to public accounts and instituted funds are hereby discontinued. These guidelines supersede and repeal the N500,000 cash withdrawal limit of local government funds and also, since it is for a criminal purpose, supersedes the CBN’s regulation on cash withdrawal limit with regards to public accounts and instituted funds.

“There is nothing in these guidelines to suggest or indicate there is reason to compel or warrant a public official at federal, state, and local government to go to a financial institution to withdraw cash. In the unlikely event that a public official feels he may need cash withdrawal, he may apply for approval for a waiver from the Presidency which may be granted on a case-by-case basis.”

The statement further said, “the application of these guidelines includes all foreign missions operating in Nigeria, accounts of all development partner institutions, and the accounts of all instituted funds in form of independent funds to be operated as mutual funds such as insurance funds, cooperative funds, brokerages funds, political party funds or pressure group/union funds, once the funds are designated to exist as funds or to operate independently for management and/or investment.”