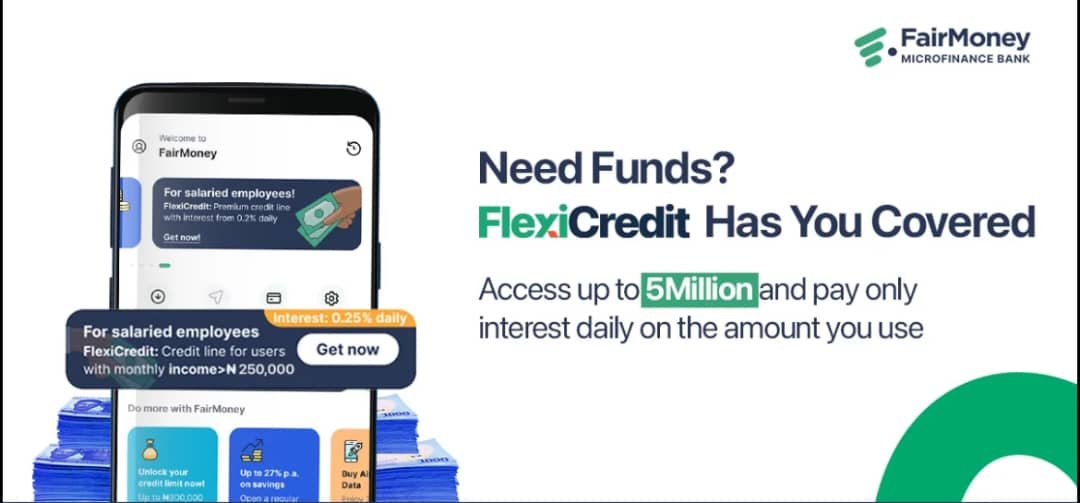

FairMoney has unveiled FlexiCredit, a new credit line designed for Nigerian Professionals.

NewsOnline Nigeria reports that FairMoney, a leading Nigerian microfinance bank, has launched FlexiCredit, a premium credit line aimed at providing professionals with instant access to funds of up to ₦5,000,000.

Designed for convenience and flexibility, FlexiCredit allows eligible users to access a personal credit limit anytime through the FairMoney app. Interest is only applied to the amount borrowed, at a rate of 0.25% per day. For instance, withdrawing ₦200,000 from a ₦1,000,000 limit for 10 days would accrue just ₦5,000 in interest, resulting in a total repayment of ₦205,000. No fees or charges are applied when the credit line is unused.

ALSO: FG Confirms Cryptocurrencies Now Taxable Under Nigeria’s New Fiscal Framework

Many Nigerian professionals, despite having stable incomes, often face hurdles when accessing traditional credit, including long approval times, excessive paperwork, collateral demands, and rigid repayment schedules. FlexiCredit seeks to remove these barriers, offering instant, hassle-free access to funds for urgent needs, lifestyle improvements, or business opportunities.

According to Margaret Banasko, Head of Marketing at FairMoney, “FlexiCredit is designed for the modern Nigerian professional who values speed, clarity, and control. Interest is charged only on the amount used, and once the minimum due is paid, access is immediately restored. It’s simple, transparent, and built to match the fast pace of our users’ lives.”

To qualify, applicants must be salaried employees earning at least ₦250,000 per month, have a good credit score, and complete Level Two KYC on the FairMoney app. Salary accounts are linked for instant verification, securely processed in line with NDPR and CBN data protection guidelines. Approved users have 14 days to activate their credit line, with the first withdrawal required within 60 days to maintain active status.

Repayment is flexible: users can pay the minimum due which covers a percentage of the borrowed amount plus accrued interest or settle the full amount. Minimum payments immediately restore access to the credit line, while full repayment refreshes the entire credit limit. Monthly due dates are clearly displayed in the app for user convenience.

With the launch of FlexiCredit, FairMoney reinforces its commitment to providing fast, reliable, and accessible financial solutions for Nigeria’s growing professional class. The product is currently available on Android, with an iOS version expected soon.